Bitcoin, surrounded by mainstream media headlines of scams and multi-million-dollar losses, is actually safer than your bank account. A lot of people think their savings accounts are the safest place to park their money, but that couldn’t be further from the truth.

The Bitcoin network is completely decentralized, meaning there is no single, specific point that can fail. Decentralization also means that Bitcoin cannot be hacked because there is no centralized point to hack into.

A global network of nodes, run by various individuals, is what supports the Bitcoin network. If one of these nodes goes down, there is no effect on the network itself.

Bitcoin is open and permissionless, so anyone can join the network by just downloading and running an app, without any need to provide personal information. This eliminates the risk of identity fraud that is common in the traditional banking system.

Bitcoin also uses a Proof-of-Work system to secure the network.

Bitcoin’s Proof-of-Work (PoW) algorithm is a system that secures the network by requiring miners—powerful computers—to solve extremely complex mathematical puzzles to validate transactions and add new blocks to the blockchain (Bitcoin’s public ledger).

This process makes Bitcoin incredibly secure because altering past transactions would require redoing all the work, which is computationally impossible.

Bitcoin’s proof-of-work, combined with its decentralized network, ensures that no single entity can manipulate transactions, providing unparalleled security and trust in the system.

While bitcoin’s price is very volatile, and the price fluctuates too much for the asset to be a reliable, liquid savings measure, the long-term trends show increasing adoption and appreciation.

Bitcoin’s price stabilizes the more widely adopted it becomes. The dollar, while less volatile, loses purchasing power every day due to inflation. In fact, about 38 million bills, valued at roughly $541 million, are printed each day by the US Treasury.

Banks are fully centralized, meaning there is a central point that can fail. In October of 2024, Bank of America (the second most popular bank in the United States) experienced nationwide outages. Clients could not access their accounts or their funds.

Because banks are centralized, a technical error in the central point can cause the whole system to go down, even the most major banks are at risk for system failures.

Also, banks are subject to mismanagement (as evident in Silicon Valley Bank 2023 case), putting the bank itself and its clients at risk.

The centralization of banks also allows hackers to breach the bank. In 2019, Capital One was breached due to a weak firewall, exposing the personal data of over 100 million customers.

FDIC insurance typically only insures $250,000 worth of funds in a bank account, but even then, you have to trust that the FDIC will reimburse your lost funds and go through the entire process of getting your money back, temporarily preventing you from accessing it.

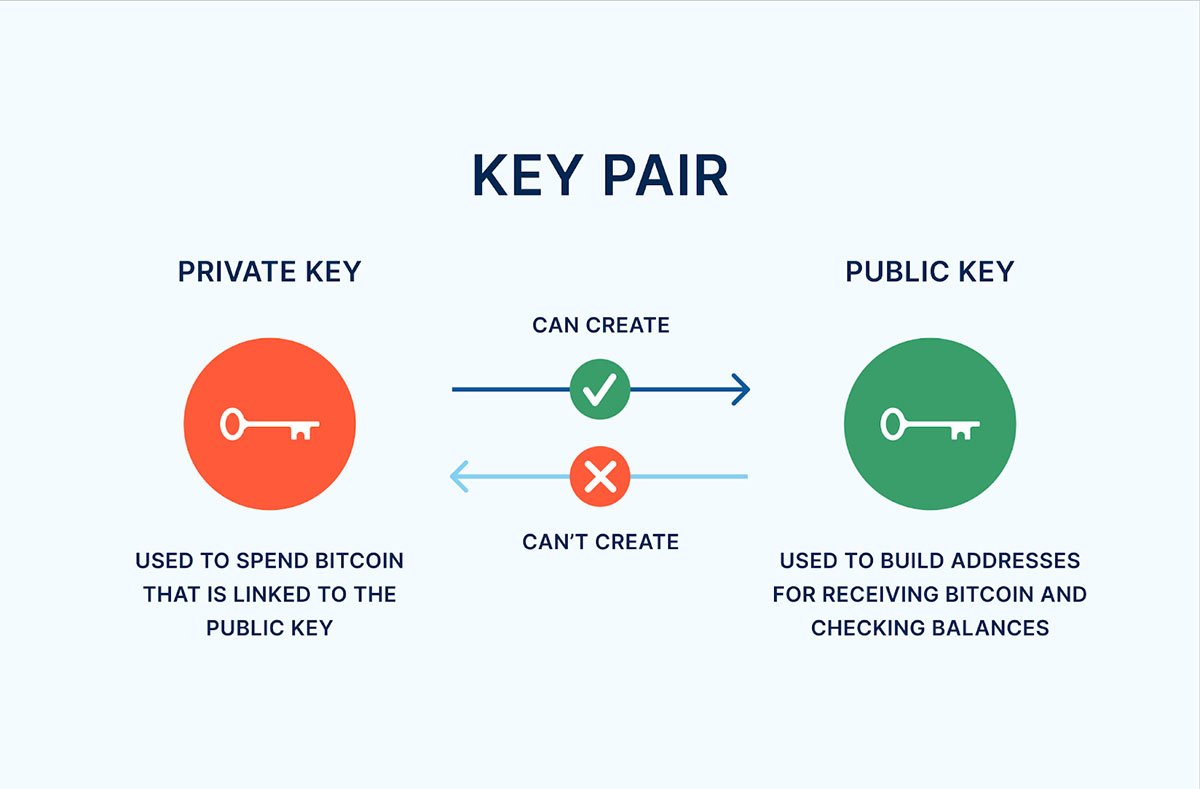

Bitcoin grants users complete control of their funds. Each wallet randomly generates a seed—a series of words—used to produce private keys, which ensures exclusive access.

A corresponding public key is derived from each private key and can safely be shared to receive bitcoin.

Because the funds themselves reside on the blockchain (not in the wallet), the wallet’s primary role is to store the private keys securely, enabling users to manage and move their bitcoin without intermediaries.

While to many self-custody is a massive benefit, it is possible to misplace/lose your private keys.

It is important to utilize proper private key storage practices, such as using a hardware wallet to manage your wallet, writing the seed phrase down (using a metal backup is best practice), avoiding storing keys on internet-connected devices, etc.

In contrast, banks have control over the user’s account. They can freeze accounts, impose withdrawal limits, and can even confiscate funds if they’re legally required to do so.

While it appears that the user has control over their funds, that could not be further from the truth. The bank has control of the funds and allows the user to access and withdraw them. The Federal Reserve has set the reserve requirement to 0.00%.

Related: From Fractional Reserve Banking to 0% Reserves | A Case for Bitcoin

This means that when you deposit your money in your bank, they are legally required to keep none of the money you deposit. The dollar bills you deposit in the bank may very well not be there the next day.

You could deposit $200 and see the number on your account go up by $200, but that money is not actually your money, and you have no control over it.

Rather, it is a credit the bank gives you, promising that if you want to withdraw that $200, they will find any $200 they have and allow you to withdraw it.

Bitcoin is shifting the power to the people. Banks have been the dominant way to protect your money over the past century, but Bitcoin is uprooting that idea.

Banks have continued to fail their customers by restricting access to accounts, having poor security measures, having unsatisfactory and outsourced customer service, high fees, and not having sufficient technology to prevent mass outages.

Bitcoin is solving all of these problems, and gives each person the opportunity to be their own bank and cut the middleman out of their life.

Bitcoin does come with difficulties. Yes, managing your private keys means you are responsible for the money, but it’s better than having to ask permission to use your money.

By granting individuals true financial freedom and autonomy, Bitcoin challenges the inefficiencies of traditional banking, offering a more transparent, secure, and empowering path forward for the future of money.