Key Takeaways

- Franklin Templeton has filed for an XRP-focused ETF with the SEC.

- The proposed XRP ETF aims to track the token’s price performance and will trade on the CBOE BZX Exchange.

Share this article

The Chicago Board Options BZX Exchange (CBOE) has submitted a 19b-4 form on behalf of Franklin Templeton, proposing a rule change to list and trade shares of the Franklin XRP ETF in the US.

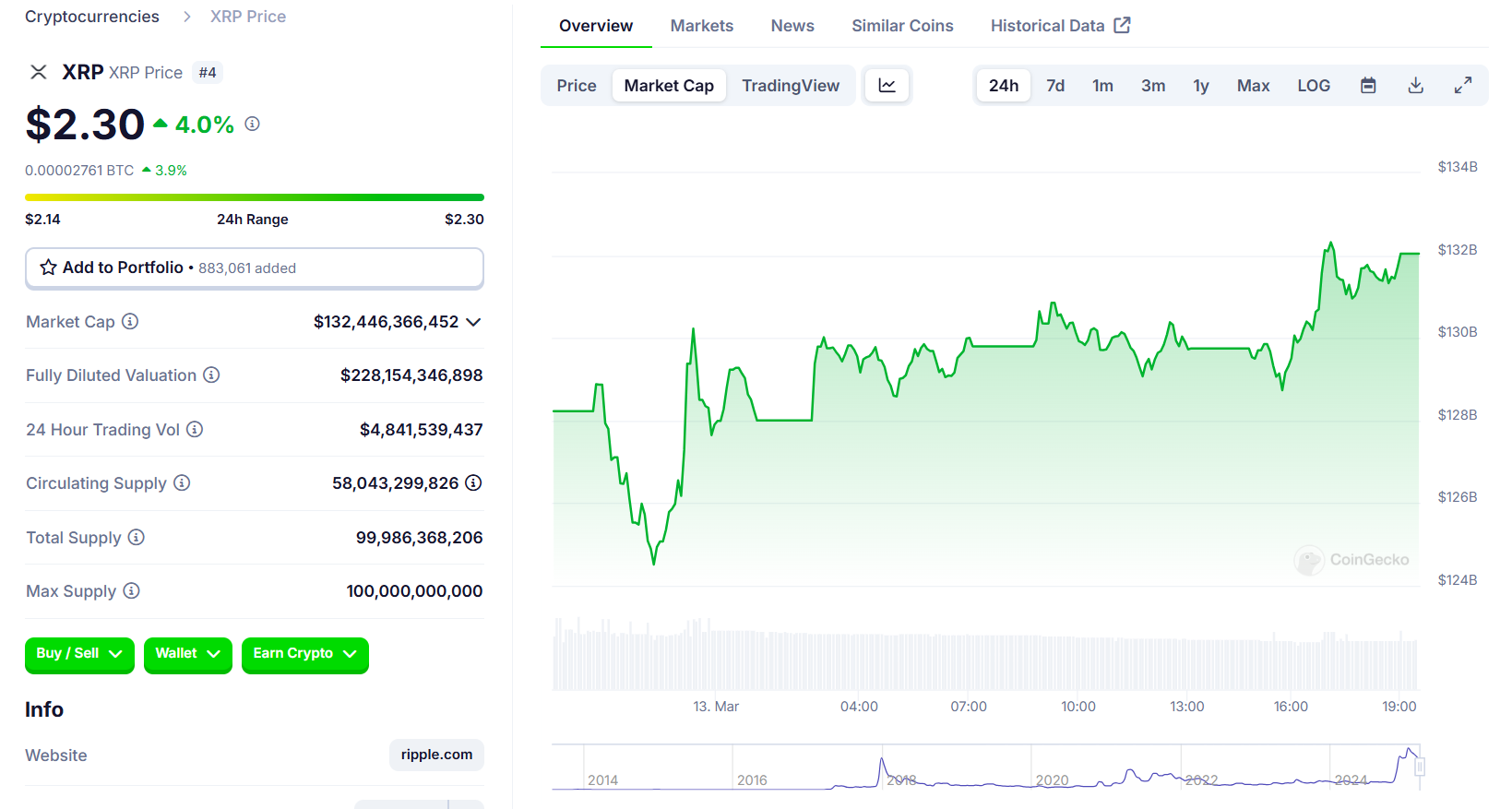

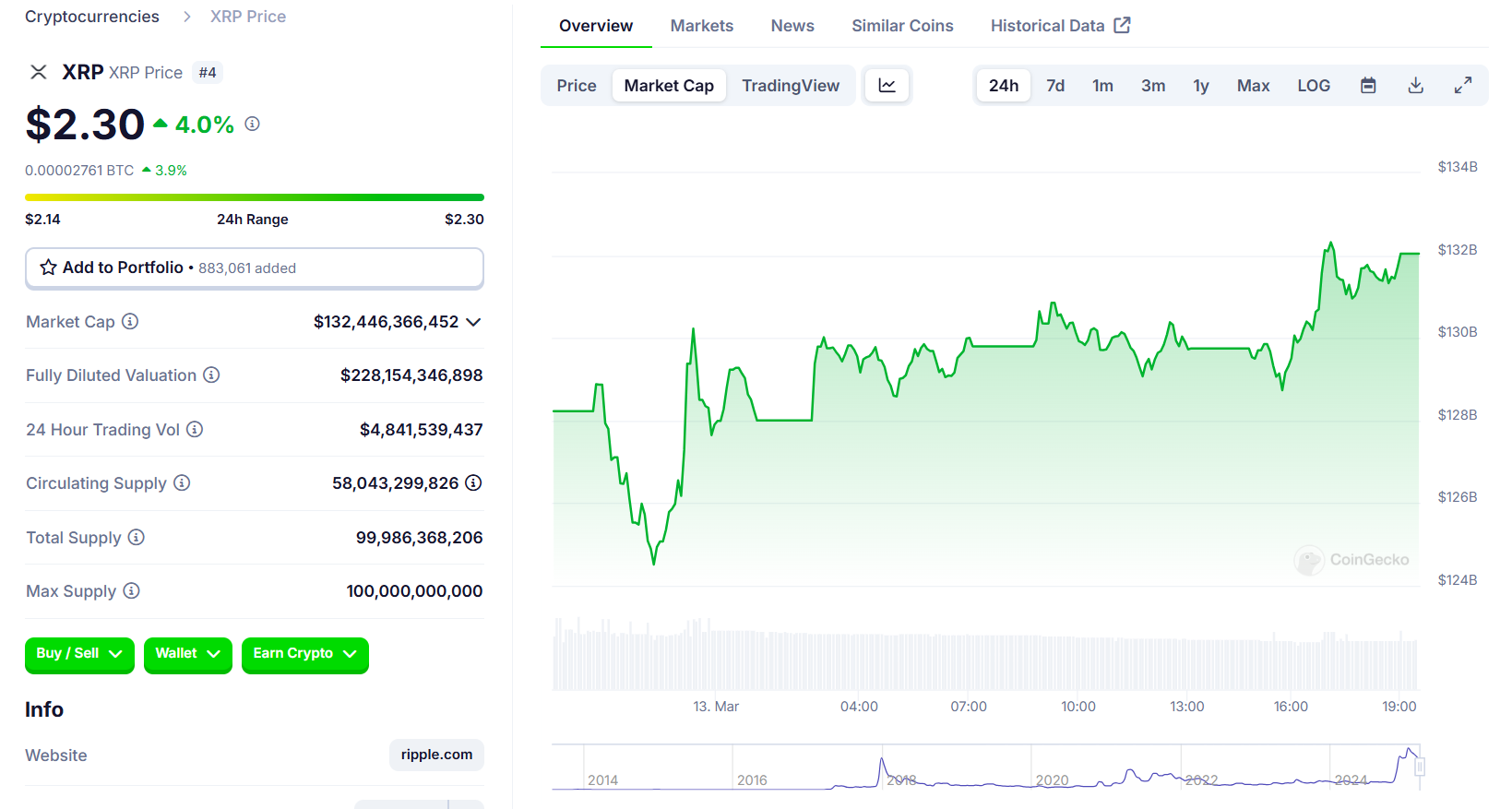

The filing came shortly after Franklin filed an S-1 registration form with the SEC for its proposed investment product focused on XRP, the fourth-largest crypto asset by market capitalization. The digital asset surged 2% to $2.3 after the SEC filing surfaced, according to CoinGecko data.

The leading asset manager, overseeing $1.6 trillion in client assets, has joined a growing list of major firms seeking approval for ETFs tied to crypto assets beyond Bitcoin and Ethereum.

The proposed Franklin XRP ETF will trade on the CBOE BZX Exchange with Coinbase Custody serving as the custodian for its XRP holdings. The fund aims to track XRP’s price performance, offering investors exposure to the digital asset without requiring direct custody.

The filing follows Franklin Templeton’s recent expansion into crypto ETFs, including a Solana ETF filing and previously launched spot Bitcoin and Ethereum ETFs. Other firms awaiting regulatory approval for XRP ETF proposals include Bitwise, 21Shares, Canary Capital, Grayscale, and WisdomTree.

ETF analyst James Seyffart noted that while delays are standard procedure, there are “relatively high odds of approval” for these altcoin ETFs by October 2025.

Share this article