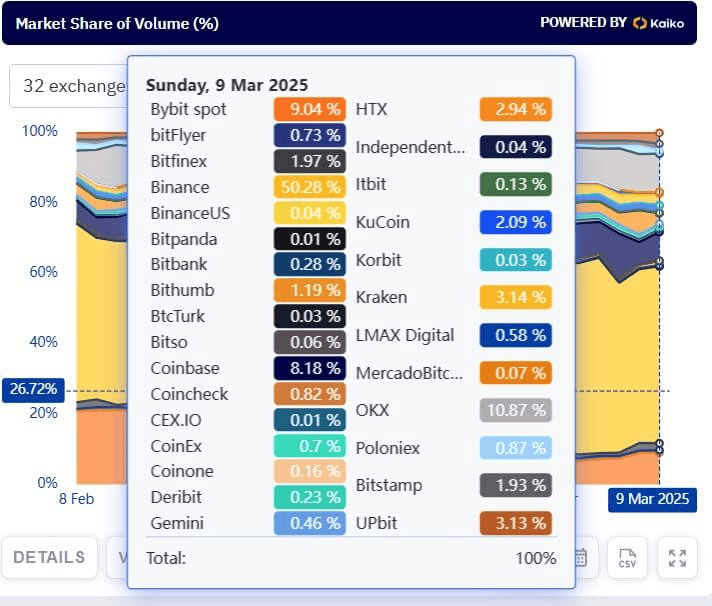

Bybit’s market share has seen a sharp decline following the hack.

According to Kaiko data, the platform previously held nearly 20% of the global crypto trading market before the security breach. Now, it is just a single digit.

Bybit’s Market Share Declines

In the immediate aftermath of the hack, Bybit’s market share plummeted to just 5% by March 2, 2025, as users and traders likely moved their funds to safer exchanges due to security concerns.

During this period, Binance emerged as the biggest beneficiary, with its market dominance soaring to 62% as traders sought a more secure and liquid platform.

Other major exchanges, such as OKX and Coinbase, also saw minor increases in market share, reflecting a broader redistribution of trading activity.

Share Recovery

Bybit has shown signs of recovery, with its market share rebounding to 9.04% as of March 9, 2025.

A key factor in Bybit’s survival was its swift crisis response. Unlike many exchanges that suspend withdrawals during security breaches, Bybit kept its platform operational, allowing users to access their funds. This decision, along with consistent updates, helped maintain confidence and prevent mass withdrawals.

However, the exchange still faced significant reputational damage and lingering trust issues, raising doubts about whether it can fully regain its pre-hack position.

Fund Recovery Update

Despite these efforts, recovering the stolen funds has proven to be a slow and complex process.

At the time this article was written, only $43.71 million—around 3% of the total stolen assets—has been frozen. Bybit, however, has honored its commitment to offer a 10% bounty on recovered funds, distributing $4.32 million to individuals and groups that assisted in freezing assets.

The North Korean Lazarus Group, the suspected perpetrators, has already laundered at least $300 million, making further recovery increasingly difficult.

Read BitPinas’ coverage on Bybit hack: Bybit Hack Update Timeline: North Korea’s Lazarus Group Responsible for Largest Crypto Hack in History

Local Opinions on the Bybit Hack

Paolo Dioquino of DeFi Philippines dismissed the idea of an Ethereum rollback after the $1.46 billion Bybit hack, explaining that the exploit targeted Bybit’s interface, not Ethereum itself.

- He argued that Ethereum’s network functioned correctly and that reversing transactions would be impractical, harm trust, and disrupt the ecosystem.

BayaniChain CEO Paul Soliman described the Bybit hack as a classic social engineering attack in which North Korea’s Lazarus Group tricked Bybit’s security team into signing a fraudulent transaction using a fake UI.

- He emphasized that the blockchain itself remained secure, but human error was exploited.

This article is published on BitPinas: Bybit Loses Market Share After Hack as Binance Gains Ground

What else is happening in Crypto Philippines and beyond?