On March 20, investor and entrepreneur Anthony Pompliano stated on Fox News, “There’s a global race going on–Russia, Abu Dhabi, El Salvador, Bhutan–all these other countries are trying to buy Bitcoin… the same way that there was a space race there’s now a Bitcoin race.”

The idea of a Bitcoin “race” is now a reality as world leaders actively discuss the urgency of either establishing digital asset reserves or embracing cryptocurrency as legal tender.

El Salvador, in 2021, became the first country to make Bitcoin legal tender, purchasing over 2,000 Bitcoin as part of a national reserve to foster financial inclusion and economic growth. The move has been both celebrated and criticized due to Bitcoin’s volatility. Similarly, in 2022, the Central African Republic became the second country to adopt Bitcoin, viewing the cryptocurrency as a tool to improve economic development and financial inclusion in one of the world’s least developed nations.

Both countries’ actions reflect growing interest in Bitcoin as an alternative financial strategy. It’s hard-capped at 21 million, and in 10 years, most of it will be mined.

The theory is that the countries considering Bitcoin a valuable reserve asset will strive to establish as much ownership of the total BTC supply as possible.

Proponents believe scarcity and growing demand will drive Bitcoin’s value, making large BTC holders influential.

What Saylor says…

One of the most prominent Bitcoin evangelists, Michael Saylor, said that 78% of the U.S. was bought for $40 million at some point. The former CEO of MicroStrategy referred to various land acquisitions, such as the Louisiana Purchase of 1803 to illustrate why the U.S. government should buy Bitcoin now when it’s “cheap.”

In a recent speech, Saylor called the next decade “a digital gold rush” and compared Bitcoin to the Manhattan Project, dubbing it “digital energy.”

“Today, Bitcoin represents the digital capital network, controlling 99% of power within the cryptocurrency ecosystem,” he said. “The U.S. government recognizes only Bitcoin as legitimate digital capital. To secure the future of cyberspace and maintain global financial dominance, America must adopt Bitcoin strategically. Only Bitcoin—and U.S. Treasuries—have the liquidity and global trust required to serve as reliable reserve assets worldwide.”

No wonder Saylor has been vocally supportive of government officials pushing to increase the U.S.’s BTC stockpile.

President Donald Trump, Republican Sen. Cynthia Lummis, and Bo Hines, the Executive Director of the President’s Council of Advisors on Digital Assets, have all expressed a desire to increase the U.S.’s Bitcoin reserve.

Like Saylor, Pompliano (among the most vocal crypto advocates in the U.S.) considers the Trump administration’s focus on Bitcoin dominance important.

Speaking about the future price of Bitcoin, Pompliano said during a Fox News appearance that he doesn’t know when BTC will hit one million. However, he is seemingly confident that, like gold, its value will increase from where it currently is today.

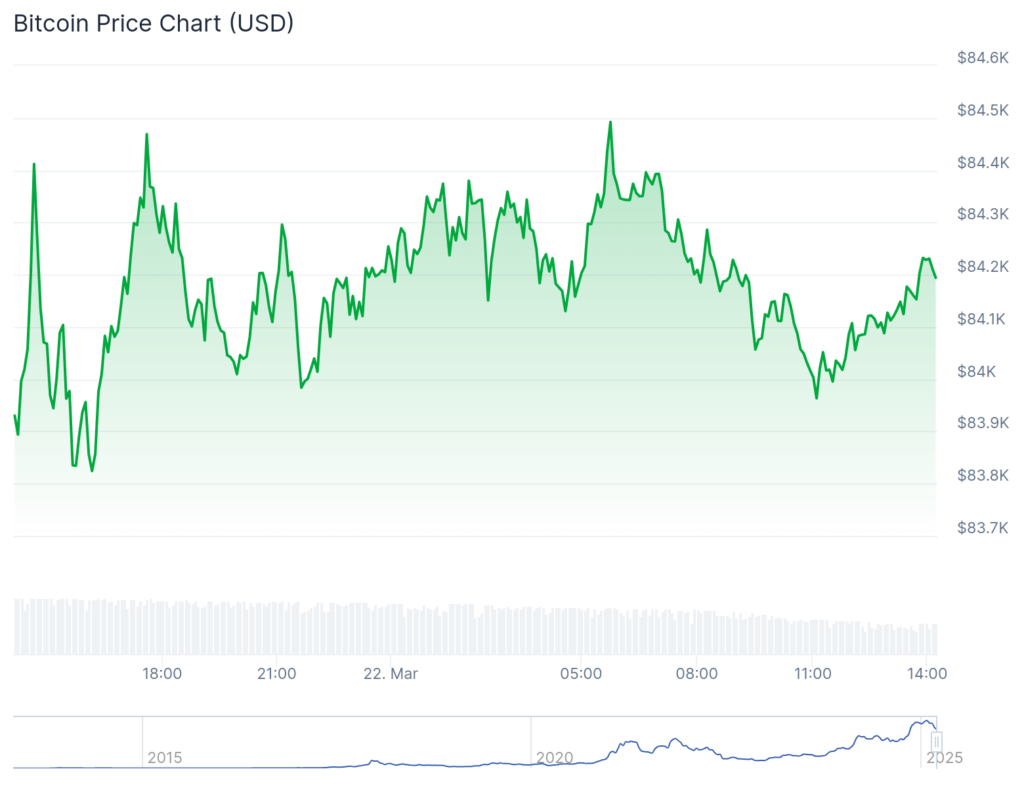

At last check, Bitcoin is trading at just above $84,000.

“I think people are drastically underestimating how maniacal they are going to be about buying Bitcoin,” Pompliano said. “Everyone thinks it’s cute that they put 200,000 Bitcoin over here and now we have this reserve — they are going to continue to buy Bitcoin.”

Who participates in the Bitcoin race?

Apart from the U.S., Pompliano named Russia, El Salvador, Bhutan, and the United Arab Emirates. Indeed, all of these countries reportedly have Bitcoin holdings, but not necessarily all of them explicitly expressed their desire to buy more.

It is not quite clear how much crypto Russia holds. However, it is known that Russia has large-scale mining operations while local companies use crypto for international trade and dodging Western sanctions.

Pompliano neglected to mention several leading Bitcoin holders, including China, which is the second biggest BTC owner after the U.S.

The United Kingdom and Ukraine currently follow China, according to BitBo’s Bitcoin Treasuries page.

All these countries have different strategies:

- North Korea’s hackers steal hundreds of millions of dollars worth of crypto from crypto exchanges.

- The UK holds crypto, seized while dismantling a high-scale money-laundering operation.

- Ukraine became a notable Bitcoin holder through donations made after the intensification of the Russian-Ukrainian conflict in 2022.

- The U.S. intends to confiscate Bitcoin and crypto assets from criminal cases. It’s worth noting that many individual states are exploring the creation of local-level reserves.

More than that, some corporations, most notably Strategy (previously MicroStrategy) and asset manager BlackRock, are among the world’s biggest Bitcoin holders, capable of competing with leading nations in terms of Bitcoin dominance. Both firms own or manage around 500,000 Bitcoins (over 2% of the total supply). As of March 2025, no country holds even half that amount.

Many countries are opting out

European countries have been cautious and innovative in their interactions with blockchain solutions. For instance, Estonia is one of the world’s pioneers in adopting blockchain for elections and healthcare data management. However, the EU countries take a conservative stance when it comes to crypto reserves. High volatility and low liquidity are the main reasons for rejecting Bitcoin’s reserve establishment.

Similar reasons are cited by Switzerland, South Korea, Japan, and other countries that seem unbothered by America’s passion for winning in the Bitcoin musical chairs game. Germany went so far to sell thousands of Bitcoin.

Germany sold all their #Bitcoin at $54,000.

If they had waited, they could have made an extra $990 million.

Losers🤣🫵 pic.twitter.com/2G8iRFhzn9

— Crypto Rover (@rovercrc) November 6, 2024

Crypto.news asked Genius Group, a company using Bitcoin as a corporate reserve, how they time the market.

“As fundamental believers in the long-term potential of Bitcoin, we don’t try to time the market, but rather buy and hold with the intention of never selling,” a spokesperson responded.

Let’s assume the so-called Bitcoin race exists, as Pompliano described it. If we compare it to space or the Manhattan Project, we must ask ourselves: Were the countries that didn’t have spacecraft or atomic weapons in the 20th century left with nothing?