Key Takeaways

- Base’s tweet transformed into a tradable token that quickly became a $17 million liquidity trap.

- Despite controversy, Base defended the tokenization as a content creation experiment.

Share this article

Base dropped a vibe and accidentally launched a rollercoaster.

Coinbase’s layer 2 network, Base, is sparking controversy after a piece of content it posted was auto-minted into a tradeable token via Zora.

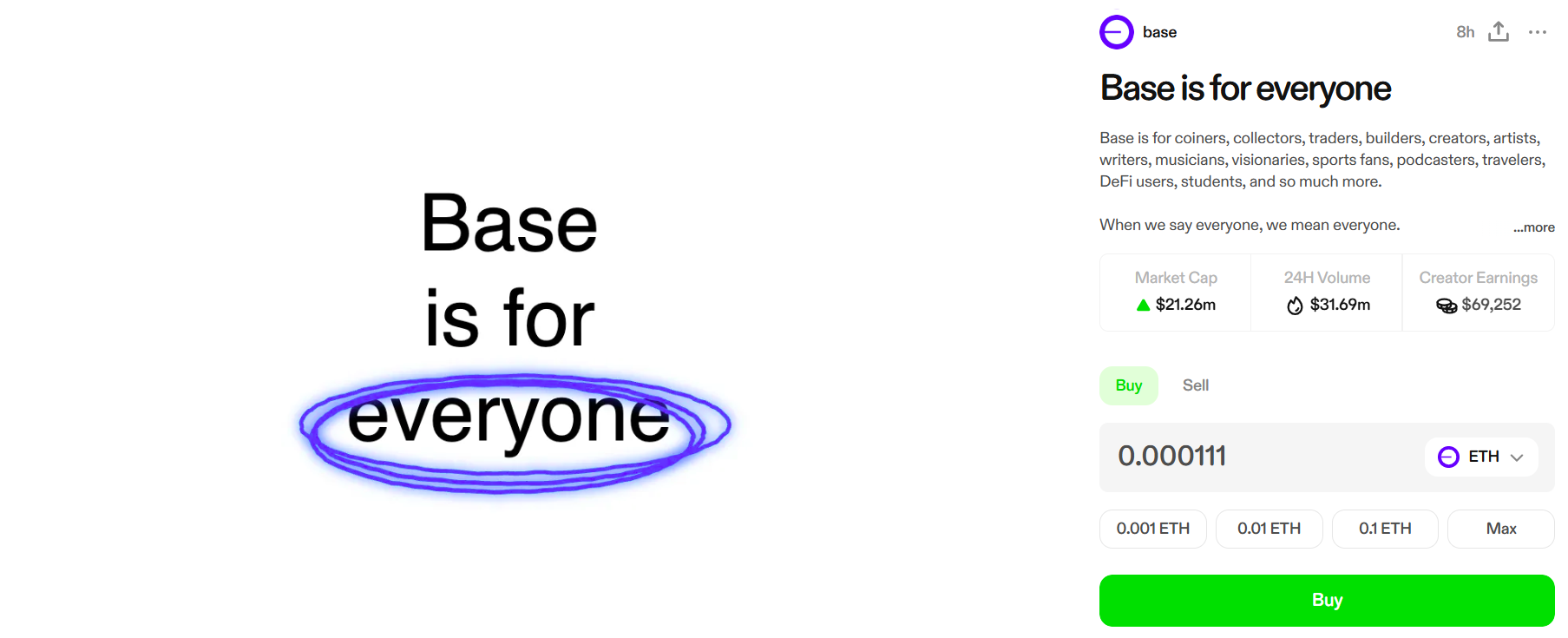

The token, which the team described as experimental, quickly moonwalked to over $17 million in market value, nosedived within hours, and then rebounded back to above $20 million.

What happened?

Base’s official X account on Wednesday posted a “Base is for everyone” message, followed by another post stating “coined it” with a link to Zora—indicating their message had been minted as an ERC-20 token on Zora.

Base is for everyone. pic.twitter.com/gq3lLLuXO1

— Base (@base) April 16, 2025

Just coin it. https://t.co/RB6BF9wrjh

— Base (@base) April 16, 2025

Even with Zora’s disclaimer stating the “Base is for everyone” token wasn’t official, that didn’t stop a speculative wave that lifted its valuation above $17 million before it tumbled around 94% to $1 million in just a few hours, according to DEXScreener data.

The crypto market initially responded with a mix of skepticism and sarcasm following the rapid rise and collapse of a token minted from the Base tweet.

so we’re at the stage of the cycle where Base is just launching memecoins off of the main account

what the fuck has happened to our industry man pic.twitter.com/Vcnf8r06ZF

— intern ⨀ (@intern) April 16, 2025

Coinbase fresh off the SEC dropping its case against it, decides to boldly parlay that W into launching it’s own Base token from the official account. Naturally, it immediately rugged it. pic.twitter.com/AxFvRjOaAX

— Beanie (@beaniemaxi) April 16, 2025

On-chain analyst Hantao Yuan reported that the top three wallets controlled nearly 47% of the token’s supply, with one wallet alone holding 25.6%.

Yuan also noted the presence of volume bots contributing to the rapid rise and fall of the token’s price. Over 2,500 wallets were impacted, with many users claiming they were misled or caught.

Let me get this straight

> base tweets a token on their main account

> Top 3 holders had 47% of the supply (sold a lot)

> Jesse defends it

> Posts 2 more tokens

> “This is culture”

> Rugs 2500 holders (potentially new base users) pic.twitter.com/NM4CY04eUa— Hantao (@Hantao) April 16, 2025

In a follow-up statement post-incident, the Base team framed the experiment as part of an effort to tokenize content. Although Base received 10 million tokens as the creator, the team stated they would not sell them.

Base is posting on Zora because we believe everyone should bring their content onchain, and use the tools that make it possible.

Memes. Moments. Culture.

If we want the future to be onchain, we have to be willing to experiment in public. That’s what we’re doing.

To be clear,…

— Base (@base) April 16, 2025

Still, many users across the ecosystem were left confused by the execution and market response.

Elsewhere, some Solana-based projects responded with sarcasm.

touching grass is not enough. we need to tokenize it

— Phantom (@phantom) April 16, 2025

does my boss have a pet?

asking for a friend

— Raydium (@RaydiumProtocol) April 17, 2025

Commenting on the case, Alon, co-founder of Pump.fun, said Base’s actions could become normal in a few years but are out of step with today’s market expectations. He said the decision to tokenize content without considering current market realities caused real harm to users.

While Alon supports the vision of “tokenizing everything,” he stated that social influence brings responsibility.

I think there’s a reality where what base did is normal in a few years’ time

but it DEFINITELY isn’t today and that has resulted in hurt

I’m a huge advocate for the vision of “tokenizing everything” but you can’t change current market realities – if you launch a coin AND have…

— alon (@a1lon9) April 16, 2025

After the fall, a swift rebound

After a rapid collapse, the token has recovered, achieving a peak of approximately $23 million. At the time of writing, its valuation stands at around $18 million.

The token’s total trading volume surpassed $30 million in less than 12 hours, per data from Zora. The coin has generated approximately $70,000 in creator earnings for Base since its launch.

Despite the controversy, Jesse Pollak, Base’s creator, advocates for normalizing on-chain content creation. He encouraged brands within the Base ecosystem to use Zora to tokenize content.

In a series of posts, Pollak shared the benefits of tokenizing ads, posters, and videos, citing increased virality, deeper community engagement, and new revenue opportunities.

He described the initiative as a “new form of marketing” and said that the Base core team is willing to pioneer this approach.

The timing is interesting. Last month, Coinbase brought back plans to tokenize its $COIN stock in an effort to bring blockchain-based securities into the US financial system.

Share this article