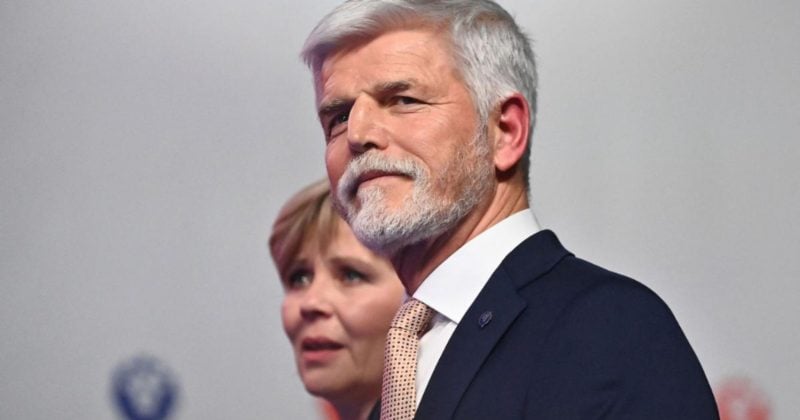

Czech Republic President Petr Pavel. Photo: AFP

Key Takeaways

- The Czech Republic will exempt Bitcoin from capital gains tax if held for more than three years.

- The new legislation aligns Czech crypto regulations with the EU’s MiCA framework starting mid-2025.

Share this article

The Czech Republic will exempt Bitcoin and other digital assets from capital gains tax for holdings kept longer than three years, following President Petr Pavel’s signing of new legislation that aligns crypto taxation with traditional securities.

🇨🇿 CZECH PRESIDENT SIGNS LAW ELIMINATING CAPITAL GAINS TAX ON #BITCOIN HELD OVER 3 YEARS

HUGE WIN FOR CZECH REPUBLIC 🚀 pic.twitter.com/LSvIm0jdze

— The Bitcoin Conference (@TheBitcoinConf) February 6, 2025

The law removes tax disadvantages for digital assets by introducing a personal income tax exemption for individuals on crypto profits after a three-year holding period. The exemption applies only to non-business activities.

“The amendment will come into effect in mid-2025,” aligning the Czech Republic’s regulations with the European Union’s Markets in Crypto-Assets (MiCA) framework.

The legislation, approved by the Chamber of Deputies in January, puts digital currencies on equal footing with traditional financial instruments.

Under the new rules, crypto holders who sell their assets after the specified three-year period will not be required to pay income tax on profits.

The law represents part of broader changes aimed at modernizing tax regulations in the Czech Republic, particularly concerning emerging technologies and financial innovations.

Last month, the Czech National Bank considered incorporating Bitcoin into its foreign exchange reserves as a diversification strategy.

It’s Official

Czech Central Bank Plans Bitcoin Reserve

(Bloomberg) pic.twitter.com/6GqCxN954Z

— Willem Middelkoop (@wmiddelkoop) January 29, 2025

The move positions the country as a pro-Bitcoin environment within the European Union, potentially influencing other member states’ policy decisions.

Share this article