Key Takeaways

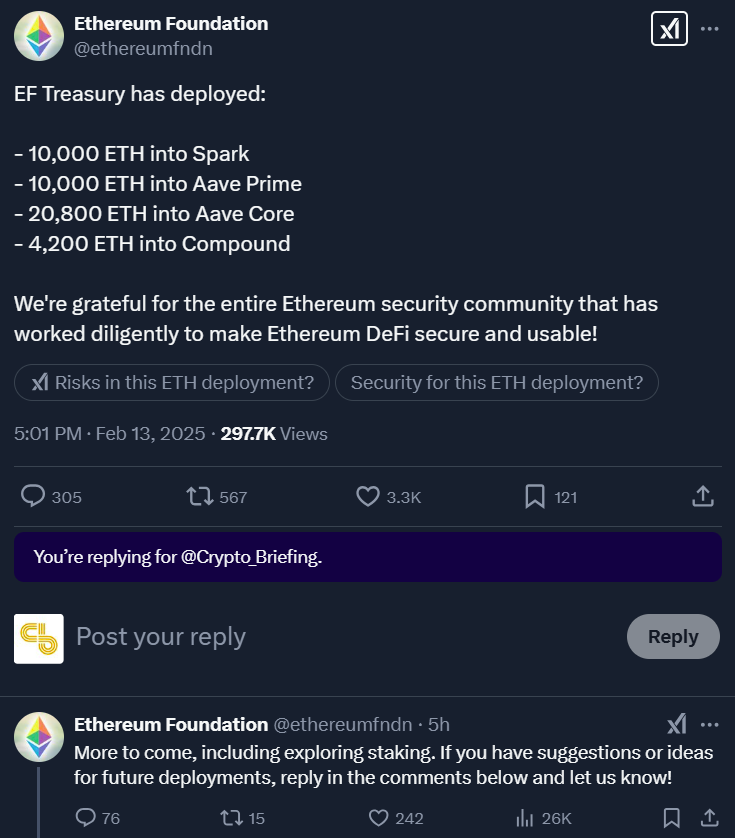

- The Ethereum Foundation allocated 45,000 ETH worth approximately $120 million across four DeFi protocols.

- Vitalik Buterin remains the sole decision-maker during the Ethereum Foundation’s restructuring process.

Share this article

The Ethereum Foundation has hinted at exploring staking after depositing 45,000 ETH across multiple DeFi protocols.

The foundation on Thursday distributed around $120 million worth of ETH across four major DeFi platforms, with Aave Core receiving the largest share at 20,800 ETH. The entity also sent 10,000 ETH to Spark and Aave Prime each, and 4,200 ETH to Compound.

The EF’s engagement with DeFi follows intense pushback from the crypto community regarding their frequent ETH sales for operational costs and lack of ecosystem involvement. Community members had previously urged the foundation to consider staking its ETH holdings or participating in the DeFi ecosystem for financial management.

Responding to criticism, Vitalik Buterin explained that the EF indeed looked at those options.

However, Buterin noted that maintaining neutrality during contentious hard forks remains a key challenge. Staking would inherently align the EF with one side of a fork, compromising this neutrality. The Ethereum co-founder also dismissed suggestions of running both forks or unstaking, citing the slashing mechanism and limited withdrawal rate as impractical.

Briefly after debate surrounding the EF’s treasury management, Hsiao-Wei Wang, a key member of the EF Research team, announced that the EF set up a number of multisig wallets and immediately allocated 50,000 ETH to these wallets.

Ethereum Foundation Treasury Update

The Ethereum Foundation (@ethereumfndn) has set up a new @safe 3-of-5 multisig wallet.

The wallet address is 0x9fC3dc011b461664c835F2527fffb1169b3C213e

An op has been initiated to send 50,000 ETH there, but be patient; due to signing delays,… pic.twitter.com/sIkAlH8ROf

— hww.eth (@icebearhww) January 20, 2025

The crypto community reacted positively to Thursday’s allocation, calling it a big move from the EF.

This is the way. EF making big moves. Aave as a modular infrastructure and Spark liquidity layer can bring state of the art liquidity management for EF treasury.

DeFi will win. https://t.co/3jffRXZ5rS

— Stani.eth (@StaniKulechov) February 13, 2025

30,800 ETH deployed by Ethereum Foundation into Aave.

Biggest allocation in DeFi by EF.

DeFi will win. https://t.co/DoJ3N5lKRF

— Stani.eth (@StaniKulechov) February 13, 2025

They deployed:

– 10,000 ETH into Aave with a different logo

– 10,000 ETH into Aave

– 20,800 ETH into AaveThe rest for diversity.

Just use Aave. https://t.co/S0QOhZ9OKX

— Marc “Billy” Zeller 👻 🦇🔊 (@lemiscate) February 13, 2025

Few years late but glad these noobs finally worked out how to use DeFi. The number one USP that made Ethereum what it is today, and why long term I do see the chain winning on smart contract adoption in the broader world of finance. https://t.co/giihDYCD0A

— ALΞX (@CrossChainAlex) February 13, 2025

Apart from treasury management, the EF also faced internal pressures regarding its leadership direction.

Buterin stated that he would maintain sole decision-making authority over the EF until the organization completes its restructuring process to establish proper leadership.

Share this article