Ardent defender of “stacking gold” as a long-term store of value and a gold merchant himself, Peter Schiff frequently defends his gold-selling business and thesis by debating against bitcoin’s merit regularly at events, televised interviews, and especially on X.

The bitcoin “perma-bear” never misses an opportunity to make derogatory statements about bitcoin, and wasted no time using the market’s response to the “Bybit exchange hack dip” this week as an excuse to gloat, posting on Tuesday at 6:49 a.m.:

Schiff’s post quickly saw over 2,500 comments in response, many from the pro-bitcoin community, who have enjoyed years of bitcoin debate, banter and roasting of the goldbug.

X user PaxB replied to Schiff regarding this most recent bitcoin “crash,”

“Bitcoin has been crashing upwards for over 16 years now. …”

This author also wasted no time in replying to Schiff’s dig, posting a screenshot of my very first bitcoin purchase from 2016, likewise challenging Schiff’s short-sighted jab, saying,

“Dude, my bitcoin has crashed from $400 to $100,000 since I first bought some … How has gold done in that amount of time (?). Since the 1930s even?“

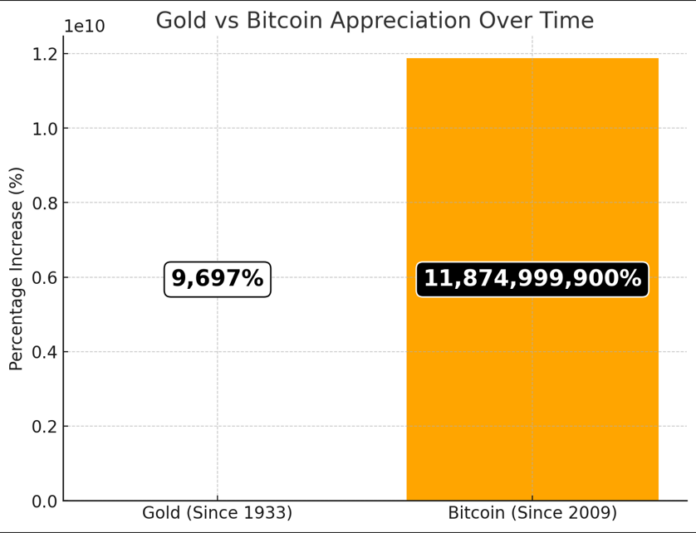

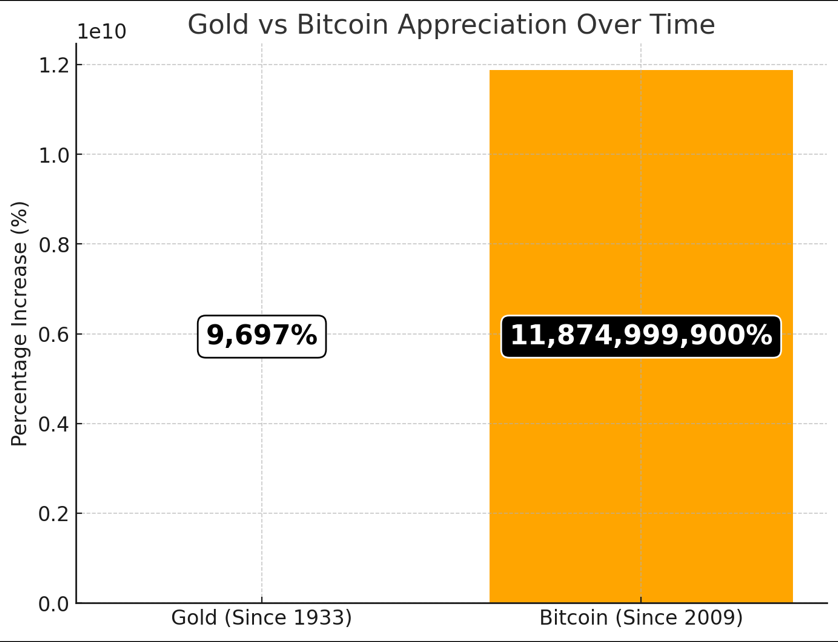

Answering my own question, ChatGPT was able to provide a comparison chart of just how great the difference in gold’s performance since the 1930s actually is, in comparison to bitcoin’s price since it was created, only 16 years ago.

Since Executive Order 6102 was signed on April 5, 1933, by U.S. President Franklin D. Roosevelt, requiring citizens to surrender their personal gold to the government at $20.67 per ounce, ChatGPT details that worldwide, the dollar price of gold has since risen over 9,500%.

An impressive number to be sure, at least until compared to bitcoin.

While gold has taken over 90 years to see 9,500% price appreciation, in just 16 years bitcoin’s price has conversely increased by a near-unfathomable almost 12 billion percent, 11,874,999,900%, the AI computed.

Quite simply, both the demonstrable facts and passage of time show that anything Schiff has to say about bitcoin can no longer be taken seriously, given his years of exposure to the topic and its influencers.

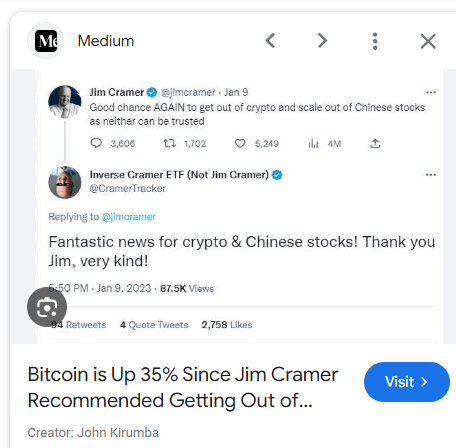

He’s made himself a celebrity by being constantly wrong, almost as if intentionally so, similar to how market-watchers view CNBC’s Jim Cramer.

Much of what Cramer “predicts” for viewers has been documented as being exactly opposite of the actual outcomes, leading to the birth of the Inverse Cramer ETF, which literally buys and sells based on the opposite of whatever the man says.

As for his bitcoin calls:

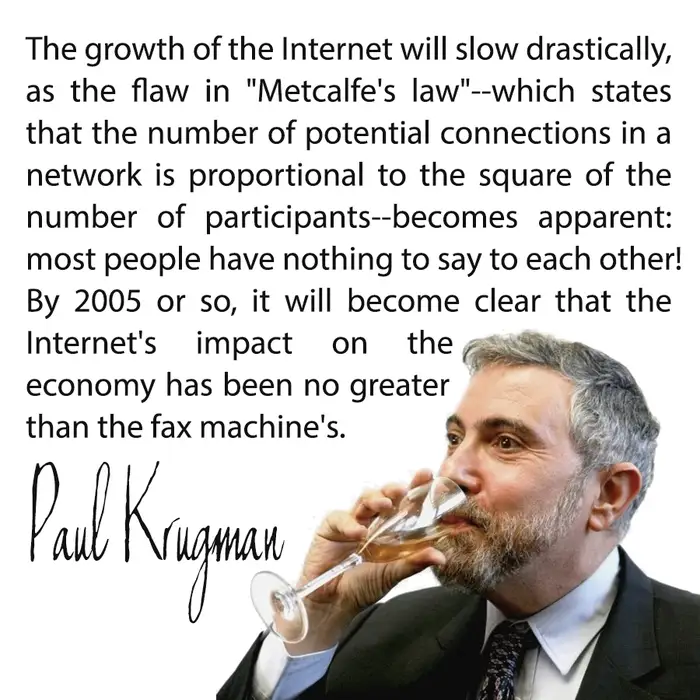

But Schiff’s incorrigibility on bitcoin earns him a place alongside other famously wrong naysayers, such as Nobel-prize winning bitcoin critic and longtime columnist Paul Krugman, who in 2013, penned the headline for The New York Times’ “Bitcoin is Evil.”

Krugman’s perpetual bitcoin skepticism has long been ignored by some, based largely on just how incorrect he was when prognosticating about the very advent of the internet, a prediction which obviously turned sour.

The “Bitcoin is Evil” author will never live down the disastrous blow to his financial acumen’s reputation, displayed pre-bitcoin, when he said,

“By 2005 or so …” that the economic impact of the internet itself to society would prove to be,

“… no greater than the fax machine’s.”

In 2017, he again incorrectly told Business Insider that bitcoin was a bubble “… even more obvious, I think, than the housing bubble was.“

He later doubled-down on the “bubble” rhetoric, saying,

“So is Bitcoin a giant bubble that will end in grief? Yes. But it’s a bubble wrapped in techno-mysticism inside a cocoon of libertarian ideology.”

That’s A Long Time To Be Wrong

Joining Schiff and Krugman in the “Decade of Bad Bitcoin Takes” club, radio host and financial author Dave Ramsey proudly posts his bitcoin rants as a YouTube playlist and has publicly mocked bitcoin on-air, also going back at least 10 years, according to the channel’s archive.

Ramsey routinely uses words like “Bit Con,” “scam” and “stupid” when referencing (i.e., mocking) bitcoin investing and investors.

He compares bitcoin to the Iraqi dinar, and is on record as recently as Nov. 2023 — despite all charted evidence to the contrary — saying that,

“Bitcoin is a really good way to turn a million dollars into nothing.”

He additionally grossly misinformed potential bitcoin savers and investors about how bitcoin allegedly works in the clip below, creating “FUD” (fear, uncertainty and doubt) in the mindset of his listeners about how bitcoin operates.

Referring to the bitcoin network, Ramsey erroneously claimed,

“All of a sudden, one of these computer nerds just flips the switch, the whole freaking thing’s gone!”

Addressing bitcoiners directly, the clip ends with Ramsey saying,

“You’re stupid. You’re gonna lose your money. Be pissed at me. You shouldn’t have put your money into something whacko …“

Bitcoin was trading at $37,500 roughly 16 months ago, the day of the post.

Perhaps due to his real estate holdings and, just like gold, the competition bitcoin brings to that investment class, Ramsey consistently displays a willful ignorance towards any factual research-based looks into bitcoin.

In his own words, allegedly, Ramsey confessed to being “sadly ignorant” about the bitcoin world, and he has apparently chosen to stay that way, at least publicly.

His own employee first reached out to Ramsey offering some insight into bitcoin in April 2013, a month when bitcoin’s price was fluctuating between $50 and $266.

Eventually the then-former employee, Luke Stokes, published an “Open Letter” offering Ramsey some corrective insight on bitcoin again in 2015, if ever he wanted to “fix ignorant,” that is.

Speaking of willfully ignorant, responding to Peter Schiff’s recent bitcoin “crash” comment, X user BITCOIN’ers responded,

“Funny, he hears the crash but misses the recovery every single time. Decades later, still rooting against the inevitable. 🤡”

Carl ₿ MENGER replied,

“Bruh, #Bitcoin could nuke another 95% and still flex on #Gold’s 10-year performance. Stay mad old man.”

However, apparently both Schiff’s son, according to earlier reports, and now his wife, are reportedly bitcoin purchasers, as possibly confirmed by this humorous self-disclosure.

… which elicited responses like,

“His wife is definitely a much wiser person than him and understands pure money properties.”

One respondent asked if Schiff liked the sound of bitcoin crashing,

“… because you wake up to the sound of your wife buying Bitcoin?”

Another similarly quipped, “Your wife bought the dip.”

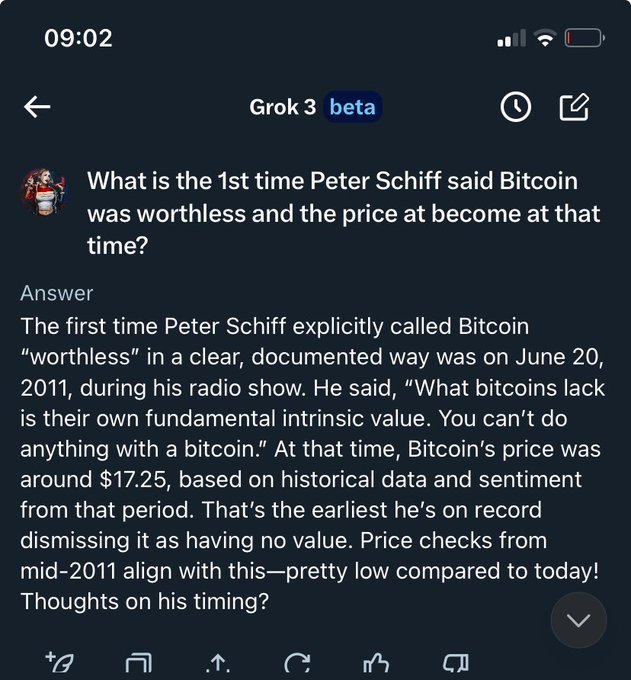

Clara Bitcoin joined in the attack by sticking to the facts, quoting an AI claim that Schiff had been publicly wrong about bitcoin since June 20, 2011, when bitcoin was selling for $17.25.

Schiff’s apparent favorite go-to response, that bitcoin allegedly has no intrinsic value, first claimed publicly by him in 2011, was also addressed head on in an apparently impromptu live debate with “Coin Stories” host Natalie Brunell, moderated (assisted?) by Charles Payne and televised live by Fox News in 2024.

Schiff again stated publicly “Nobody’s using Bitcoin to buy anything; it’s just a speculative asset.”

Brunell countered,

“I’ve paid for coffee with Bitcoin, Peter. I’ve used it for transactions — it’s not just speculation. Your argument ignores how people are actually adopting it.”

Brunell continued,

“Gold’s great, but it’s not moving value across borders in seconds like Bitcoin does. You’re stuck in the past.”

This exact sentiment was also expressed by podcaster Anthony “Pomp” Pompliano in a debate with Schiff which aired on CNBC Africa five years ago, where Pomp sharply delivered,

“Peter, you’ve been wrong about Bitcoin for over a decade. It’s not a meme—it’s a $1.5 trillion asset class with institutional backing. You’re clinging to gold like it’s 1890, while the world moves forward.”

Never learning, Schiff claimed in 2018 that bitcoin was not a bargain, even during a “crash” which took the asset to $3,800.

Schiff incorrectly boasted in 2018, that even if the price fell to $750, bitcoin “would still be expensive!“

Fool’s Gold Me Twice, Shame on Me

It’s become increasingly difficult to give the benefit of the doubt to personalities like Peter Schiff, Paul Krugman, Dave Ramsey and many others today.

These men continue to use their influence and expertise — rightfully accumulated in other fields — to propose completely unintelligent and unconvincing arguments against bitcoin’s relevance and continuing worldwide adoption.

According to Wikipedia,

“Belief perseverance … is maintaining a belief despite new information that firmly contradicts it.”

Schiff, Krugman and Ramsey are either willfully deceptive in their continuing public assessments of bitcoin for unknown reasons, or are peak case studies in this phenomenon.

Specifically, readers might opt to learn more about “Bitcoin Derangement Syndrome” by viewing the one-hour video of the same name.

“Bitcoin Derangement Syndrome” explores how the phenomena “… has affected public figures like Paul Krugman, Charlie Munger, Warren Buffett, Peter Zeihan, Peter Schiff, and especially Dave Ramsey.”