99Bitcoins analysts and Bloomberg are calling it—a 90% chance the SEC will greenlight a spot Litecoin ETF by year’s end. Will Litecoin boomers finally get vindicated?

It seems so! Often, many of us thought that the next time Litcoin hit an all-time high holders would all have dementia and wouldn’t remember their keys.

Looks like we were all wrong.

Why Litecoin Stands Out in 2025

Litecoin’s origins as a leaner, faster spin on Bitcoin make it a strong contender for regulatory approval. Built on the same proof-of-work system, the groundwork is already in place.

Filings such as its S-1 and 19b-4 forms have landed on the SEC’s desk, inching it close to being the third official cryptocurrency to receive an ETF.

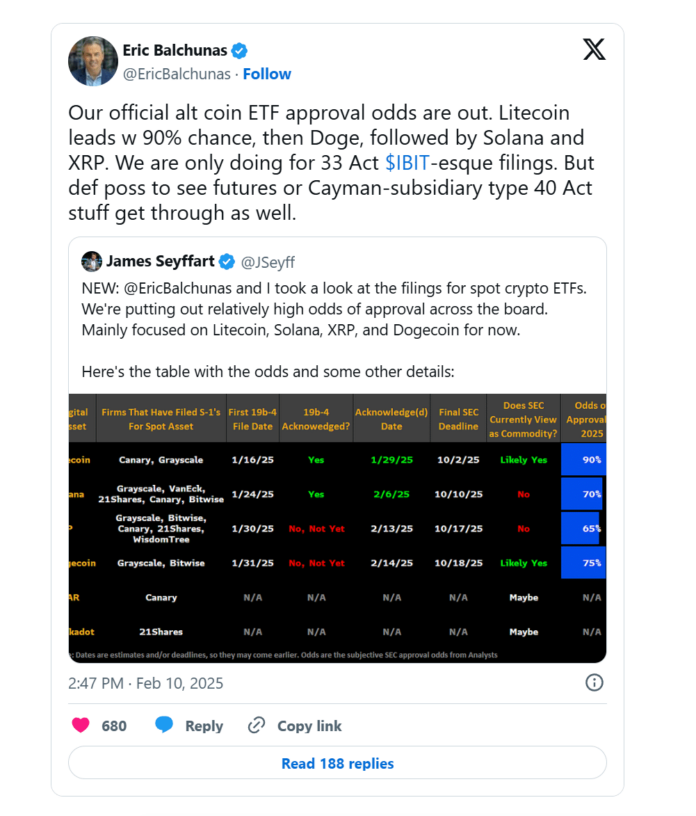

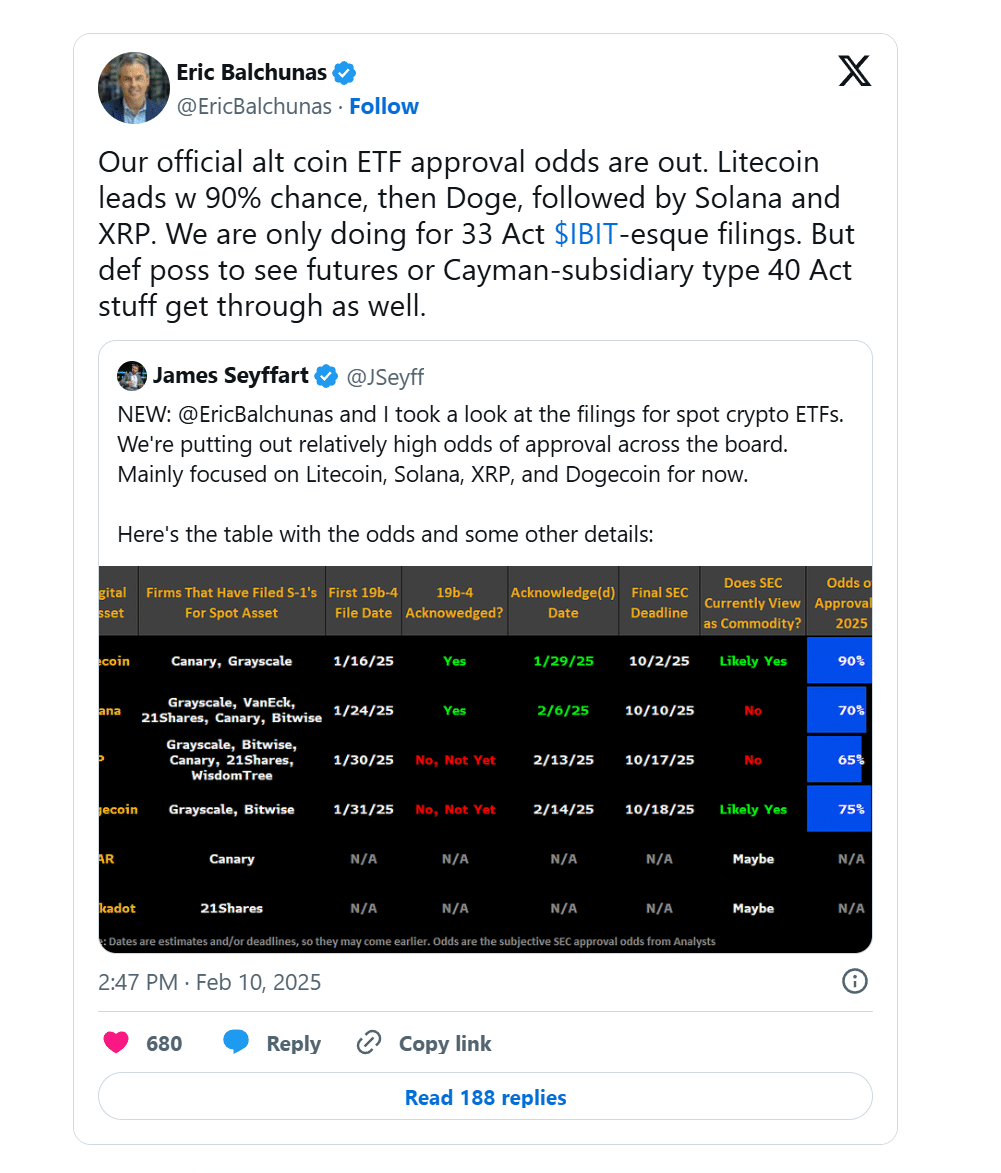

Bloomberg analysts Seyffart and Balchunas argue that Litecoin’s classification as a commodity rather than a security sets it apart. This regulatory clarity places it ahead of many cryptocurrencies that are still stuck in the hazy gray areas of classification.

Comparing Odds for Crypto ETFs and Litecoin

Litecoin leads the crypto ETF pack, with Bloomberg analysts favoring its SEC approval at 90%—well ahead of Dogecoin at 75%, Solana at 70%, and XRP at 65%.

XRP remains stuck in legal limbo over its categorization as a security, and Solana isn’t faring much better. Dogecoin shows promise, for God knows why, but lacks the procedural head start Litecoin enjoys

Investor appetite for crypto ETFs is undeniable. Since January 2024, Bitcoin ETFs have seen $40.7 billion in inflows, with $3.18 billion pouring into Ethereum funds.

A Litecoin ETF could spark fresh interest in the coin touted as “silver to Bitcoin’s gold,” legitimizing altcoins in traditional finance.

Looking Ahead For Altcoin ETFs As a 2025 Bull Run Catalyst

Meanwhile, XRP and Solana remain stuck in regulatory limbo. XRP’s partial legal win—confirming its secondary market trades aren’t securities—hasn’t cleared its ongoing SEC lawsuit. Solana also faces unresolved questions about its token classification, which is locking both projects out of ETF consideration for now.

Deadlines for SEC decisions fall between October 2 and October 18, 2025, with Litecoin poised to cross the finish line first, thanks to its clear regulatory path. Waiting in the wings are proposals for Hedera and Polkadot, backed by firms like Canary Capital and 21Shares, hoping for their own breakthroughs.

A green light for Litecoin’s ETF would mark a key moment in crypto’s maturation, with traditional investors gaining easier, safer entry points into the digital asset space

EXPLORE: Dave Portnoy’s New Meme Coin Went 100,000% But What Is The Best Meme Coin to Buy?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Litecoin (LTC) Leading The Pack for Next Crypto ETF: 90% Chance of Approval appeared first on 99Bitcoins.