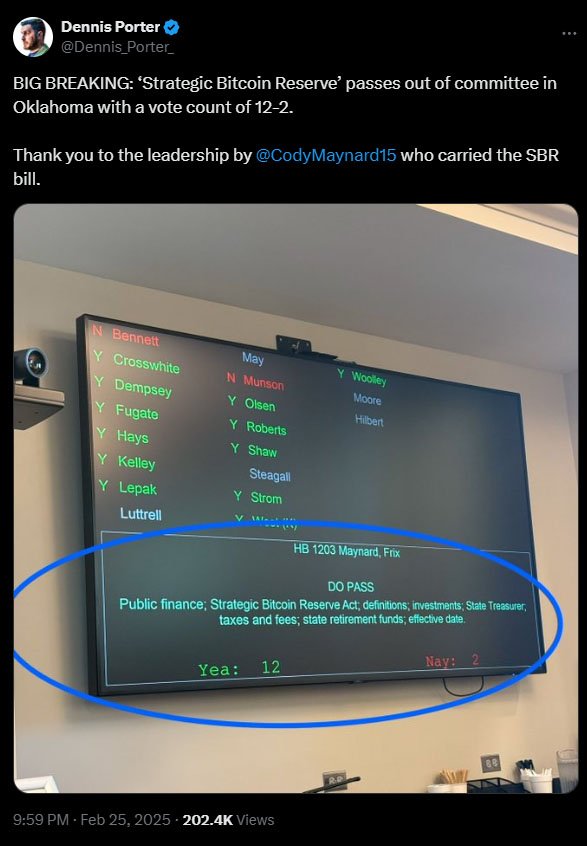

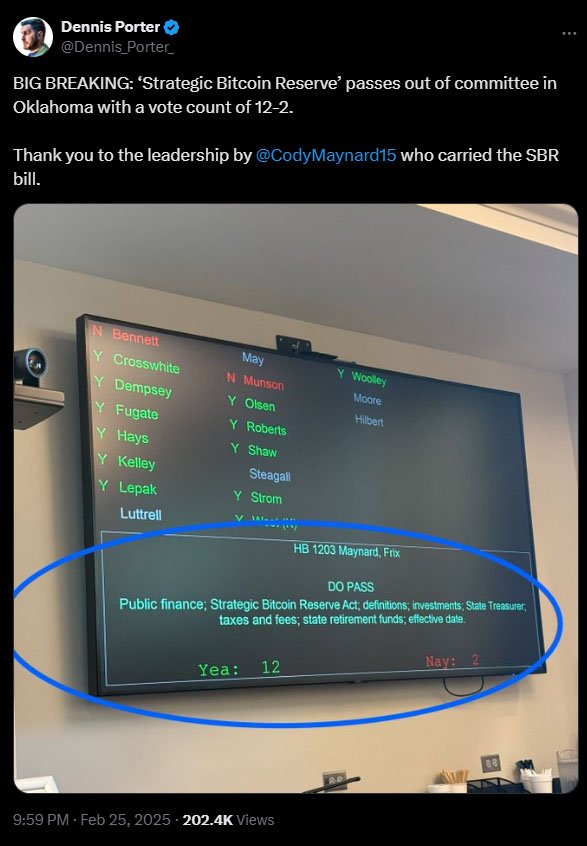

Oklahoma inches closer to becoming the first US state to invest in bitcoin as part of its public funds. A new bill, the Strategic Bitcoin Reserve Act (HB 1203), just passed the House Government Oversight Committee 12-2 and is heading to the House floor for a final vote.

If approved, this bill would allow the Oklahoma State Treasury to invest up to 10% of public funds in digital assets with a market cap of at least $500 million. Right now, bitcoin is the only one that meets that requirement.

Supporters of the bill believe investing in bitcoin would protect Oklahoma’s economy from inflation and secure the state’s financial future. Rep. Cody Maynard who introduced the bill, calls bitcoin a strong store of value saying:

“Bitcoin represents freedom from bureaucrats printing away our purchasing power.”

He explained diversifying the state’s funds by including bitcoin would ensure economic stability and protect residents’ savings from government monetary policies that could weaken the US dollar.

Another big Bitcoin activist in Oklahoma is State Senator Dusty Deevers who has introduced a separate bill called the Bitcoin Freedom Act (SB 325).

This bill would allow workers to receive salaries in bitcoin and businesses to accept it as payment. Deevers thinks these laws will make Oklahoma a leader in financial technology and strengthen the state’s economy.

“The initiative could make Oklahoma a national leader in adopting financial technology, mitigating inflation’s impact,” Deevers said.

Not everyone is for the bill, though. Some lawmakers worry about bitcoin’s price volatility and the risk of investing taxpayer money in digital assets. Montana Rep. Steven Kelly—who opposed a similar bill in his state—warned:

“It’s still taxpayer money, and we’re responsible for it, and we need to protect it. These types of investments are way too risky.”

Critics say bitcoin’s value fluctuates too much, making it a bad investment for state funds. They also worry about how big government bitcoin buys could impact the market.

Despite the opposition, Oklahoma has been Bitcoin-friendly. In May 2024 it passed the Bitcoin Rights Bill (HB 3594) which protected residents’ right to own, store and use bitcoin without government interference.

The bill also prohibited additional taxes on Bitcoin transactions and individuals mining bitcoin from needing a money transmitter license.

Now with the Strategic Bitcoin Reserve Act moving forward, Oklahoma is cementing its status as a Bitcoin-friendly state. If passed, it would go into effect November 1, 2025.

While Oklahoma is moving forward with Bitcoin adoption, other states are pushing back. Montana, North Dakota, Pennsylvania, South Dakota and Wyoming have all rejected or blocked bitcoin reserve bills, citing market volatility and taxpayer risk.

But some states are still exploring Bitcoin. Ohio introduced its bitcoin reserve bill and Pennsylvania Representative Mike Cabell is proposing 10% of the state’s treasury balance sheet go to bitcoin.

At the federal level, there have been discussions about a national bitcoin reserve but no decision has been made yet. Former President Donald Trump’s administration showed interest in Bitcoin-related policies but no official approval has been given.

The next step for the Oklahoma bitcoin reserve bill is a full House vote where lawmakers will debate, amend and vote on the bill.