As a solopreneur, you’re responsible for your business’s growth and handling payroll for one employee, including tax calculations, filings, and record-keeping. Managing all these can be stressful. Fortunately, payroll software and services can automate these processes and save you from potential payroll errors.

Here’s my list of the top 10 pay processing software to help you run payroll for 1 employee.

Top one-employee payroll software comparison

| Our rating (out of 5) | Starting monthly price | Pay runs via mobile app | 24/7 customer support | |

|---|---|---|---|---|

| Square Payroll | 4.00 | $35 + $6 per employee | Yes | No |

| Justworks | 3.91 | $50 + $8 per employee | No | Yes |

| QuickBooks Payroll | 3.9 | $50 + $6 per employee | No | 24/7 live chat |

| Gusto | 3.88 | $40 + $6 per employee | No | No |

| Paychex Flex | 3.65 | Custom | Yes | Yes |

| OnPay | 3.59 | $40 + $6 per employee | No | No |

| RUN Powered by ADP | 3.58 | Custom | Yes | No |

| Patriot Payroll | 3.49 | $37 + $5 per employee | No | No |

| Roll by ADP | 3.47 | $39 + $5 per employee | Yes | Yes |

| Deel | 3.47 | $19 per employee | No | 24/7 live chat |

| *These can end at any time. Visit the providers’ websites to check the latest promotions. | ||||

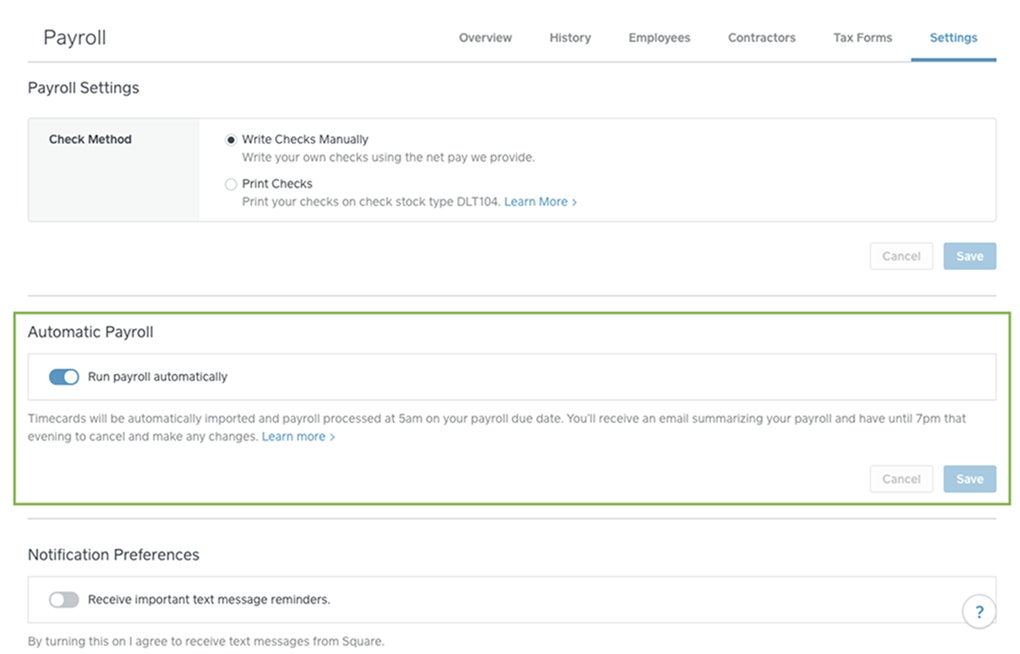

1. Square Payroll: Best overall

Our rating: 4.00 out of 5

Square Payroll helps small businesses manage their online payroll operations. It runs payroll automatically and handles tax filing across federal, state, and local tax jurisdictions, including end-of-year tax reporting. It supports various employee payment options, such as manual paychecks, direct deposits, and instant payouts via the Square Cash application. This is unlike other providers, such as QuickBooks Payroll, which requires you to upgrade to its higher plans to get same-day payments.

In addition, Square Payroll is compatible and integrates with client payment processing and accounting software, such as Square POS and QuickBooks Online. The automatic data syncs between Square and its partner programs make tip tracking and bookkeeping easy.

Pricing

Square Payroll offers two pricing plans:

- Full-service payroll: $35 per month plus $6 per employee per month.

- Contractor-only payroll: $6 per employee per month.

With an overall score of 4 out of 5 in my evaluation, Square Payroll is cheaper than Gusto and OnPay (both with monthly fees of $40 + $6 per employee). However, it has limited HR tools. Square Payroll also charges an annual fee of $3 per form if you want them to mail paper copies of payroll tax forms—although digital versions of tax documents are free.

Square Payroll pros and cons

| Pros | Cons |

|---|---|

| Easy integration with Square products | Limited HR tools |

| Intuitive mobile app with payroll features | Lacks 24/7 support and HR advisory services |

| Straightforward system and account setup |

Why I chose Square Payroll

If you have a retail or service-based business, Square’s extensive product suite makes it a good option for managing payments, point-of-sale transactions, and payroll for one employee. Its different products sync easily, and you can transfer funds from your Square balance to the Square Cash app to pay yourself instantly or send funds to your bank account for two- or four-day direct deposit payouts.

I also like its online seller community or forum, where you can connect with other small business owners and Square users. This is helpful if you need advice on boosting sales or have questions about using Square Payroll’s features.

Learn more about Square Payroll

- Read the full Square Payroll review.

- Interested in seeing how Square Payroll compares to the other payroll tools in this guide? Check these out:

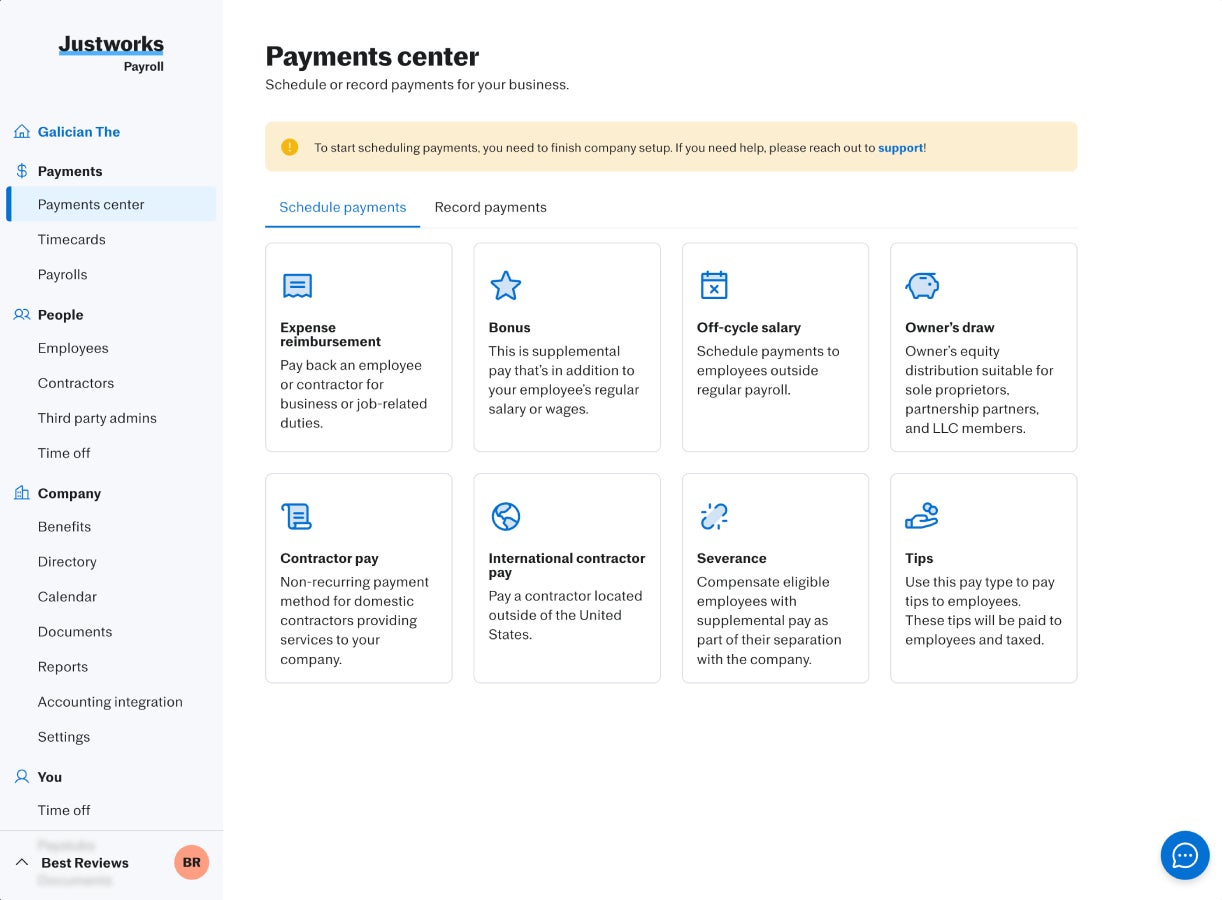

2. Justworks: Best for compliance support

Our rating: 3.91 out of 5

As a professional employer organization (PEO) service provider, Justworks handles the intricacies of pay processing to give you more time to run your business. However, apart from its PEO service, it has a payroll-only option that includes automatic wage and deduction calculations, tax filing assistance, and payroll compliance. This is great for one-employee businesses looking for a reliable payroll tool because most PEOs require at least two employees if you want to sign up for its services.

Even with its payroll-only option, you get dedicated phone support and integration options with accounting tools like QuickBooks Online for easy pay data transfers and accurate bookkeeping. It also provides real-time alerts to help keep you on top of federal and state compliance requirements. This leaves you with more time running your business instead of constantly checking labor laws and federal regulations for updates.

Pricing

Justworks Payroll costs $50 per month plus $8 per employee per month. This option doesn’t include health or retirement plans like most of the software on my list. However, if want to get medical, dental, and vision insurance, its health insurance add-on for the payroll-only plan costs $8 per employee per month. If you decide to expand your business globally and need help hiring and paying international workers, you can get its employer of record (EOR) services for $599 per employee per month.

For its PEO services, Justworks offers two plans:

- Basic: $59 per employee per month.

- Plus: $109 per employee per month.

With a 3.69 out of 5 score, Justworks Payroll may be pricier than the others on my list, but it offers more than processing payroll for 1 employee. You get the benefit of its compliance expertise as a PEO, so you’re assured that pay processes always meet federal and state regulations. You even get dedicated support from HR experts if you need guidance navigating complicated pay-related issues. Note that this service often costs extra or requires upgrading to expensive plans with other providers.

Justworks pros and cons

| Pros | Cons |

|---|---|

| Its standalone payroll option comes with dedicated phone support and assistance from HR experts | Pricey for one-employee businesses |

| Transparent pricing | Only pays via direct deposits |

| Diverse support options via phone, chat, and a 24/7 help center | Employee payouts take four business days |

Why I chose Justworks

As a solo employee, handling payroll for yourself and staying updated on tax changes can be confusing. With Justworks, you don’t have to worry about inaccurate payouts and late tax filings because it will manage these processes. This minimizes the risk of compliance issues and tax computation errors, which could lead to costly penalties.

Justworks also provides expert HR and payroll advice. Its online platform allows you to access pay-related documents and other HR features, like staff onboarding and time tracking—perfect for when you need additional HR tools to manage workers for your small business.

Learn more about Justworks

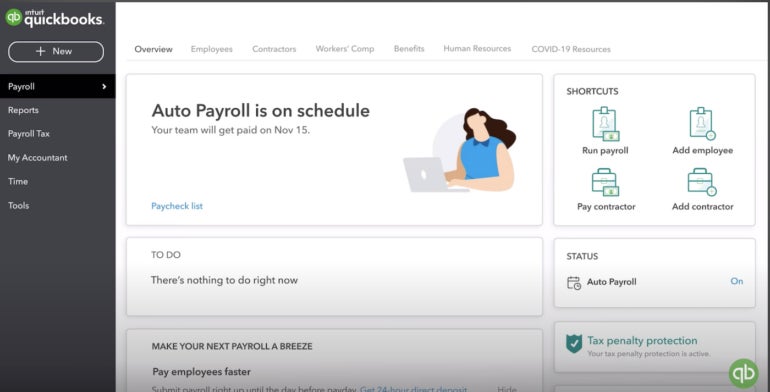

3. QuickBooks Payroll: Best for its accounting integration

Our rating: 3.9 out of 5

QuickBooks Payroll is another popular one-business payroll solution with features to help you automate payroll processes. The platform can streamline your tax and financial information to get your payroll processes up and running. It collects all necessary information from your bank account details, tax ID numbers, IRS filings, and W-2s. Over 15 customizable payroll reports are also built into QuickBooks Payroll, enabling you to view bank transactions and tax deductions in real time.

In addition to running payroll for one employee, it connects seamlessly with QuickBooks Online. Let’s say you’re using this system to manage your accounting processes. You don’t have to input pay-related items to your general ledger manually—QuickBooks Payroll will automatically transfer the applicable data to QuickBooks Online for easy bookkeeping.

Pricing

QuickBooks Payroll offers three plans:

- Payroll Core: $50 per month plus $6 per employee per month.

- Payroll Premium: $85 per month plus $9 per employee per month.

- Payroll Elite: $130 per month plus $11 per employee per month.

If you’re looking for both payroll and accounting software, QuickBooks offers packages that include both systems.

- Payroll Core + Simple Start: $85 per month plus $6 per employee per month.

- Payroll Premium + Essentials: $115 per month plus $6 per employee per month.

- Payroll Elite with Plus plan: $184 per month plus $9 per employee per month.

For both options, QuickBooks offers a discount of 50% off the base price for your first three months of service. Or, instead of a discount, you can sign up for a 30-day free trial of any plan.

While Patriot’s accounting and payroll packages may be cheaper than QuickBooks’ bundles (fees start at $47 + $5 per employee per month vs $85 + $6 per employee per month), QuickBooks’ starter bundle has more accounting functionalities, such as receipt management, invoice payment reminders, and customizable invoices. Further, Patriot’s payroll module lacks access to the medical, dental, and vision plans that QuickBooks offers via its partner provider, Allstate Health Solutions.

These functionalities contributed to its overall score of 3.90 out of 5. However, it didn’t rank higher on my list because its HR features are limited compared to providers like Gusto and OnPay.

QuickBooks Payroll pros and cons

| Pros | Cons |

|---|---|

| Easy integration between Intuit products with real-time payroll and accounting data updates | Local tax filings are limited to the Premium and Elite plans |

| Next-day direct deposit included in the basic plan |

Why I chose QuickBooks Payroll

QuickBooks Online is one of the world’s most popular accounting software, so it’s highly likely that you also use the same accounting system. And if you sign up for QuickBooks Payroll, you get a platform that’s just as user-friendly and intuitive as QuickBooks Online. Working with an interface you already understand is helpful, especially if you’re worried about making common payroll mistakes as you get used to single-employee payroll processing.

Even if you don’t use its accounting software, QuickBooks Payroll offers automated pay runs and tax payments with fast direct deposit options. Similar to Square, it has an online community where you can ask other QuickBooks users questions about the platform or payroll processing.

Learn more about QuickBooks Payroll

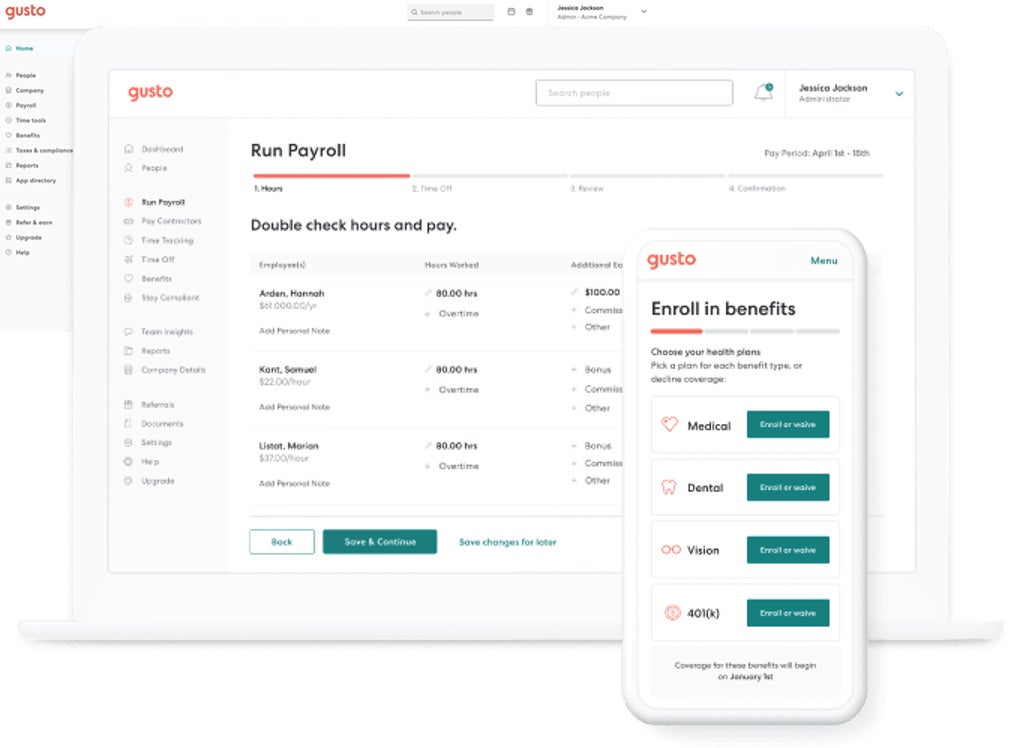

4. Gusto: Best for ease of use

Our rating: 3.88 out of 5

Gusto consistently ranks as one of the best payroll software for small companies because of its user-friendly interface. It helps one-employee businesses navigate payroll complexities by automating most HR- and payroll-related tasks. Pay runs only take a few clicks, and you can even set it to run automatically.

It offers basic to premium support that addresses complaints and questions promptly. With built-in benefits administration and Gusto as your broker, you can rely on its licensed advisors to find the right health benefits plan. Its Gusto Wallet app also provides financial management tools to help you build healthy spending habits by setting budget limits for purchases and bills, such as food and utilities.

Pricing

Gusto’s starter fee of $40 per month plus $6 per employee per month may not be as low-cost as Roll by ADP or Deel’s US Payroll plan—priced at $39 plus $5 per employee per month and $19 per employee per month, respectively—but it makes up for it with the number of features offered. Even with its starter tier, you get Gusto-brokered health benefits, full-service payroll with tax filing services, and basic HR tools to make managing time off policies, holiday pay, and employee profiles easy for you. It has three plans:

- Simple: $40 per month plus $6 per month per employee.

- Plus: $80 per month plus $12 per month per employee.

- Premium: $180 per month plus $22 per month per employee.

Gusto even has state tax registration services if you need help setting this up for your business. However, pricing varies depending on the state, so if you’re interested in this service, let Gusto’s sales team know so they can create a quote for you.

While the above features contributed to Gusto’s 3.88 out of 5 score, it didn’t outrank Square Payroll—the first on my list—because of pricing. It also doesn’t have a mobile app that lets you run payroll while on the go, a functionality that Roll by ADP excels in.

Gusto pros and cons

| Pros | Cons |

|---|---|

| Payroll on AutoPilot feature lets you pay yourself automatically | Access to HR advisors and compliance audits limited to the highest plan |

| Feature-rich platform with a wide range of HR tools, including global payroll and hiring services | Direct deposit takes up to four days if you’re on the starter Simple plan |

| Plenty of how-tos and reference materials to ensure ease of use | No mobile app for running payroll |

Why I chose Gusto

Gusto is one of the most popular payroll software in the small- and midsize-business market. It doesn’t take much time to get used to and handles wage calculations and tax filings, making it a good option to run payroll for one employee. And if you use third-party apps, like an accounting system, Gusto integrates with hundreds of software to make your life as a business owner easier. It also has a network of 401(k) providers, allowing you to find a low-cost retirement plan with deductions that sync easily with Gusto’s payroll platform.

Learn more about Gusto

- Read the full Gusto review.

- To see how Gusto compares with some of its competitors, check out the following articles:

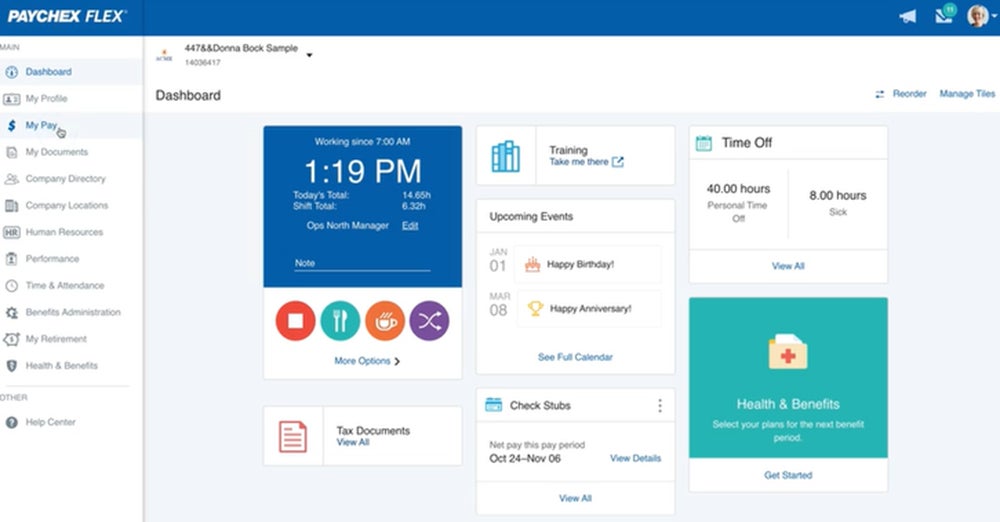

5. Paychex Flex: Best for tax and business services

Our rating: 3.65 out of 5

Paychex Flex is Paychex’s all-in-one payroll, HR, and benefits platform designed for different levels of business. With this software, you can run automated payroll from desktop or mobile devices with the option to work with a dedicated payroll specialist. It also comes with multiple payment options, such as direct deposits and same-day ACH payments. For a hands-off approach to paying yourself, its Paychex Voice Assist feature lets you use voice prompts to handle payroll reviews, approvals, submissions, and updates—a unique functionality with Paychex.

Paychex even offers solopreneurs a single-employee payroll service with 24/7 support and access to a solo 401(k) plan. In addition to managing your self-employment taxes, Paychex offers expert advice on reducing tax liabilities through deductible contributions and S Corp savings. If you need help with incorporation and startup services, Paychex’s partnership with MyCorporation allows it to help secure state and federal tax IDs, corporate formations, and business licenses. Gusto may have similar services, but Paychex’s is more extensive.

Pricing

Paychex doesn’t publish its pricing information on its website—you have to call its sales team to request a quote. For its Paychex Flex product, it offers three plans:

- Select: Custom pricing.

- Pro: Custom pricing.

- Enterprise: Custom pricing.

It scored 3.65 out of 5 in my evaluation, mainly because of non-transparent pricing. Many of its features are also included in higher tiers or cost extra. For example, fast payment options (such as same-day ACH and real-time payments) are paid add-ons to Paychex Flex plans. Employee onboarding costs extra with Paychex but is free with ADP, OnPay, and Gusto. You may also need to pay additional fees if you connect Paychex Flex with third-party accounting, HR, and hiring software.

Paychex Flex pros and cons

| Pros | Cons |

|---|---|

| Self-employed package includes incorporation services and a solo 401(k) plan | Non-transparent pricing |

| Easy to switch between desktop and mobile payroll processing (and vice-versa) | Add-on fees for onboarding, time tracking, software integrations, and benefits administration |

Why I chose Paychex Flex

Paychex is the only provider I reviewed that has a single-employee payroll service with incorporation services and a retirement plan for solopreneurs. I’m impressed with its business services, which include help with corporate formations.

Like ADP and Gusto, Paychex Flex offers several online tools to automate day-to-day payroll. I like how flexible it can be—you can start pay runs from a desktop computer and pick up where you left off via its mobile app. While it may not have Roll by ADP’s chat-based prompts, you can use its Voice Assist feature to process payroll for one employee. This is great if you want to do multiple tasks, such as running payroll while answering business emails or going through your list of client product orders.

Learn more about Paychex Flex

- Read our full Paychex review.

- To see how it compares with other payroll systems, check out these articles:

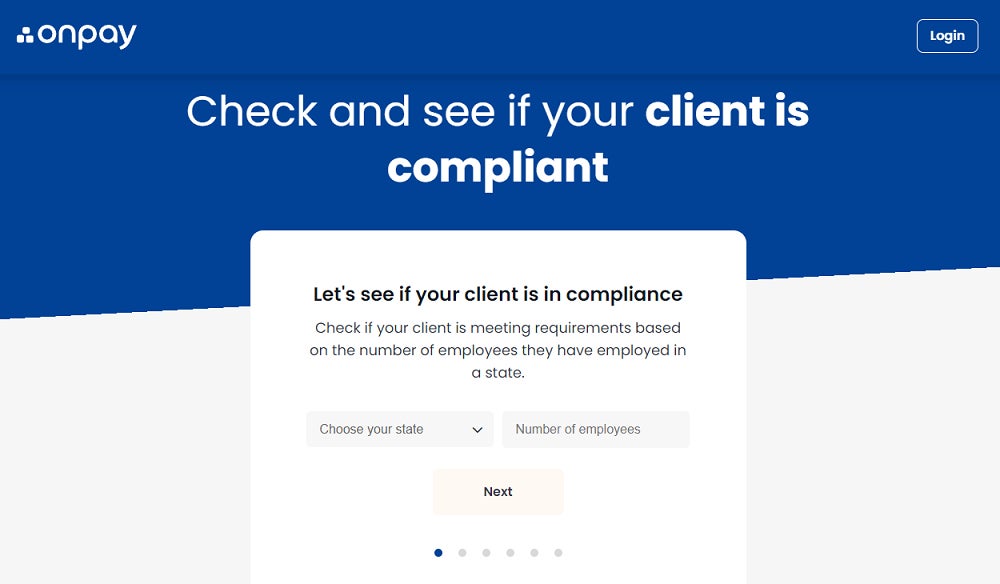

6. OnPay: Best for easy setup

Our rating: 3.59 out of 5

With OnPay, you get an online platform that can handle pay runs for businesses in all industries. This includes those with niche pay processing needs, such as companies in the agriculture sector. It processes payroll in minutes and automates tax processes—from calculations to tax payment remittances and form filings.

OnPay also has a team of professionals who can handle the payroll system setup and even create custom third-party software integrations, such as custom pay item mapping to accounting tools like Xero or QuickBooks. These services are free for new OnPay clients but may cost extra with some payroll providers. It even provides free data migration support, which helps you save time from manually inputting company details and previous pay information into the new system.

Pricing

For $6 per employee per month plus a base fee of $40 per month, you get all of OnPay’s HR and payroll features. While it costs the same as Gusto’s starter plan, OnPay provides better value for money if you’re only looking for a platform with full-service payroll and access to benefits plans and basic HR tools to manage onboarding, staff data, PTOs, and org charts.

In my evaluation, it earned a 3.59 out of 5 score. While pricing is reasonable and you get efficient tools, it lacks a mobile app and has limited integration options. For accounting, you can only connect it with QuickBooks and Xero.

OnPay pros and cons

| Pros | Cons |

|---|---|

| Payroll platform supports a wide range of industries | Limited built-in integration options |

| Free white-glove setup, custom software integrations, and data migration services | Phone, chat, and email support only available on weekdays; weekend support is via email and for emergencies only |

Why I chose OnPay

OnPay’s free client support covers more services than other payroll software providers. This allows you to focus on running your one-employee business rather than worrying about additional tasks, like setting up a new payroll system. You also get cost savings with OnPay because you don’t need to pay extra for data migration or custom software integrations.

Further, if you’re unsure whether your one-employee business meets state compliance requirements, OnPay has an online compliance checker tool. While it’s for accounting firms and accountants offering payroll services, you can use it to identify state compliance gaps you must address.

Learn more about OnPay

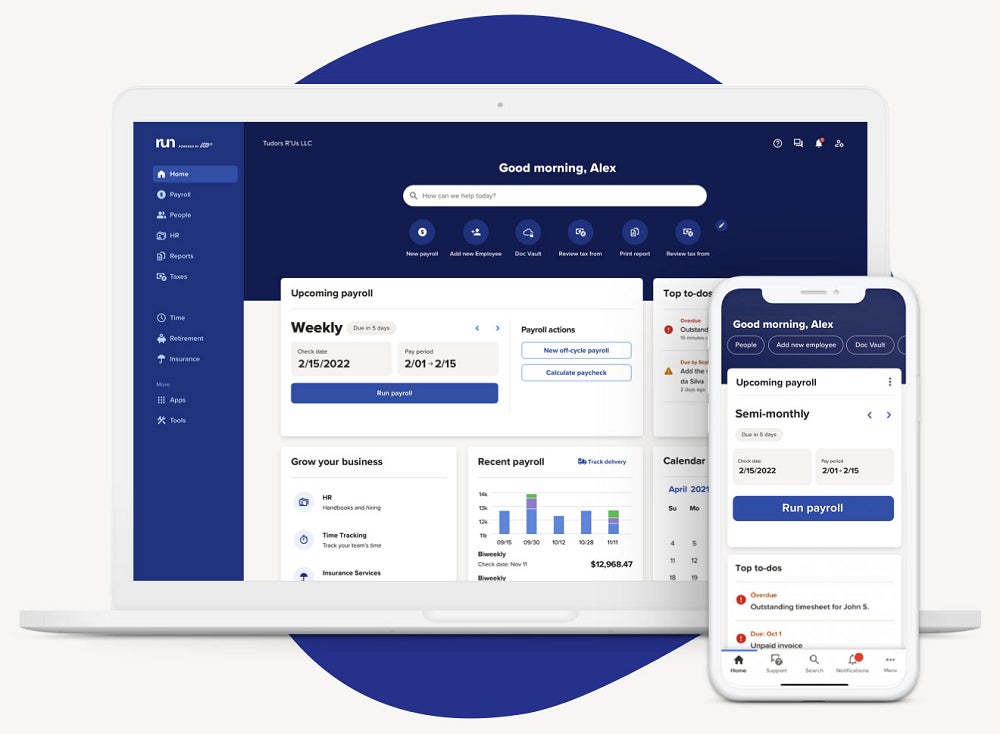

7. RUN Powered by ADP: Best for scalability

Our rating: 3.58 out of 5

ADP is a payroll services provider that offers a variety of customizable and scalable payroll solutions for businesses of all sizes. You can start with its RUN Powered by ADP product—or ADP RUN—which comes with automated payroll features, tax filing services, and benefits plans. If you decide to hire employees, this platform can handle complex payroll and HR processes like multi-state pay runs, state unemployment insurance (SUI) management, applicant tracking, and background checks. It even includes paycheck signing and delivery services in case workers prefer to receive their wages via paper checks.

If you outgrow this product and need enhanced HR and payroll features, the provider’s ADP Workforce Now product is ideal for midsized to large companies. And if you’d rather not handle payroll, you can choose ADP’s PEO service, ADP TotalSource.

Pricing

ADP doesn’t list pricing for most of its payroll solutions online. However, it does list pricing for its Roll by ADP mobile payroll tool, which starts at $39 a month plus $5 per employee per month.

Most ADP products have multiple plans. ADP RUN, for instance, has four custom-priced tiers:

- Essential: Includes full-service payroll with tax filing services, direct deposit payments, paycheck delivery to your office (if you prefer it), payroll reports, employee discounts, and access to a Google Ads tool for running campaigns

- Enhanced: Essential + job costing and paycheck signing services with secure checks

- Complete: Enhanced + salary benchmark and access to HR forms and documents

- HR Pro: Complete + web optimization tools, marketing advice from Upnetic advisors, and legal assistance from Upnetic legal services

The Essential plan is ideal for basic payroll processing. If you sign up for its higher tiers, you get additional HR functionalities and payroll services, such as paycheck signing and SUI management. However, it only scored 3.58 out of 5 in my evaluation because, similar to Paychex, pricing isn’t transparent. You need to contact the ADP sales team to get the price for each ADP RUN plan.

RUN Powered by ADP pros and cons

| Pros | Cons |

|---|---|

| Real-time pay run error alerts | Health benefits and retirement plans are paid add-ons |

| Marketing toolkit from Upnetic to help one-employee businesses build, grow, and manage digital services | Charges fees per pay run |

Why I chose RUN Powered by ADP

ADP offers a wide range of payroll software products and services for businesses of all sizes. Its payroll plans and online tools can scale with your company. You can sign up for ADP RUN to process payroll for one employee now and then move on to other ADP products if you need more advanced HR tools to handle a larger workforce in the future. And since you’re dealing with only one payroll provider, migrating payroll and employee data between ADP products is easier compared to switching to an online system offered by another provider.

Regardless of the product selected, ADP helps you stay compliant with IRS and other regulations while ensuring accurate and timely employee payouts.

Learn more about ADP RUN and other ADP products

- Read our full ADP review.

- Unsure whether to get ADP or a different payroll software? Check these out:

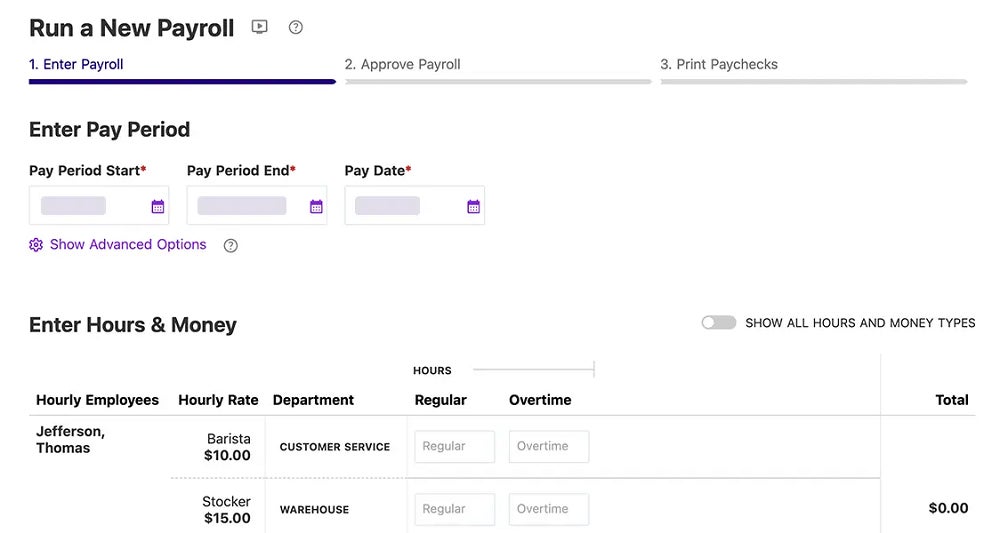

8. Patriot Payroll: Best for flexible pay runs

Our rating: 3.49 out of 5

Patriot Payroll is an online pay processing software with automated payroll and tax calculations. It has flexible payroll options that allow you to choose a full-service package with tax filing services or basic pay runs where you handle all tax filings. I recommend getting the first option, especially if you’re new to running a one-employee payroll and unsure which tax forms to file. However, if you’re adept at handling self-employment taxes and prefer to file tax forms yourself, Patriot’s basic payroll package may be right for you. In case you change your mind, you can easily upgrade to its full-service payroll plan to automate tax payment and filing processes.

Pricing

With Patriot Payroll, you get two plans:

- Basic payroll: $17 per month plus $4 per employee per month.

- Full-service payroll: $37 per month plus $5 per employee per month.

I gave Patriot Payroll a 3.49 out of 5 for its reasonably priced plans and pay processing features. I like that it has an accounting system that connects with its payroll module, making data transfers between the two products easy. Similar to QuickBooks, you can get it as an add-on solution but at slightly cheaper rates. Monthly costs for Patriot Payroll with the accounting module start at $47 plus $5 per employee, while QuickBooks charges monthly starter fees of $85 plus $6 per employee for its payroll and accounting bundles.

However, if you need more invoicing functionalities, QuickBooks offers custom invoices and reminder tools with its starter accounting package. Its payroll platform also offers next- and same-day direct deposits. Patriot’s standard direct deposit timeline is four days. It has a two-day option, but only for qualified clients.

Patriot Payroll pros and cons

| Pros | Cons |

|---|---|

| Affordable basic payroll package if you prefer to file tax forms yourself | Two-day direct deposits only for qualified customers |

| Payroll data syncs easily with its accounting module | Limited HR tools |

| Only integrates with QuickBooks |

Why I chose Patriot Payroll

As a self-service payroll plan, Patriot’s basic package can help you save money, especially if you have a limited budget. However, I only recommend this for solopreneurs with experience remitting and filing taxes themselves.

Even if you sign up for its full-service plan, Patriot Payroll offers a less expensive option than Gusto and OnPay. However, it is not as affordable as Deel’s US payroll product—provided you only need to pay one worker. While it may not have the HR functionalities these systems offer, Patriot Payroll has all the essential tools to compliantly and accurately manage one-employee pay runs.

Learn more about Patriot Payroll

9. Roll by ADP: Best for mobile payroll

Our rating: 3.47 out of 5

Roll by ADP is ADP’s chat-based mobile app designed for microbusinesses, including one-employee companies. It utilizes generative artificial intelligence (AI) tools to help you run and optimize employee payment processes. Unlike the ADP RUN app, it only runs on mobile devices and doesn’t include HR tools and benefits plans, but it can handle taxes and form filings, deductions, and garnishments with ease.

While you need to adjust to typing chat commands for Roll by ADP to make payroll adjustments, update records, and start a pay run, the learning curve isn’t steep if you’re tech savvy. This mobile app also guides you through the applicable steps, although Roll by ADP’s support team is also available to chat 24/7 if you have questions about its features.

Pricing

Roll by ADP is the only ADP product that offers transparent pricing. For a base monthly fee of $39 plus $5 per employee per month, you get full-service payroll with tax filing services. This is less expensive than Gusto, OnPay, and QuickBooks Payroll—all of which lack downloadable mobile apps that can run payroll while you’re on the go.

Its mobile pay processing features may have contributed to its overall score of 3.47 out of 5, but it wasn’t enough to rank higher on my list because of its limited services. You won’t get recommendations for a solo 401(k) plan and business incorporation assistance as you would with Paychex. It also only integrates with QuickBooks—so if you’re using a different accounting system, consider other payroll software providers like Gusto, ADP, or Square Payroll.

Roll by ADP pros and cons

| Pros | Cons |

|---|---|

| Pays via next- or same-day direct deposits | Only integrates with QuickBooks |

| Free tax savings consultations with a tax expert | Limited payroll reports |

| User-friendly app with GenAI tools | No HR tools |

Why I chose Roll by ADP

Processing one-employee payroll with Roll by ADP is easy. You only need to type “Run payroll” or a similar chat command (e.g., “Start payroll”), and it will handle all wage/tax calculations and deductions. It also walks you through the process and sends real-time pay error alerts.

What impressed me most is its AI tools, which learn from your chat commands. For example, you don’t need to tell Roll by ADP to create and follow a payroll schedule. It looks at when you typically ask it to run payroll, enabling it to line up your next employee payment tasks and send reminders about it. The other payroll systems on my list don’t have this feature.

Learn more about Roll by ADP

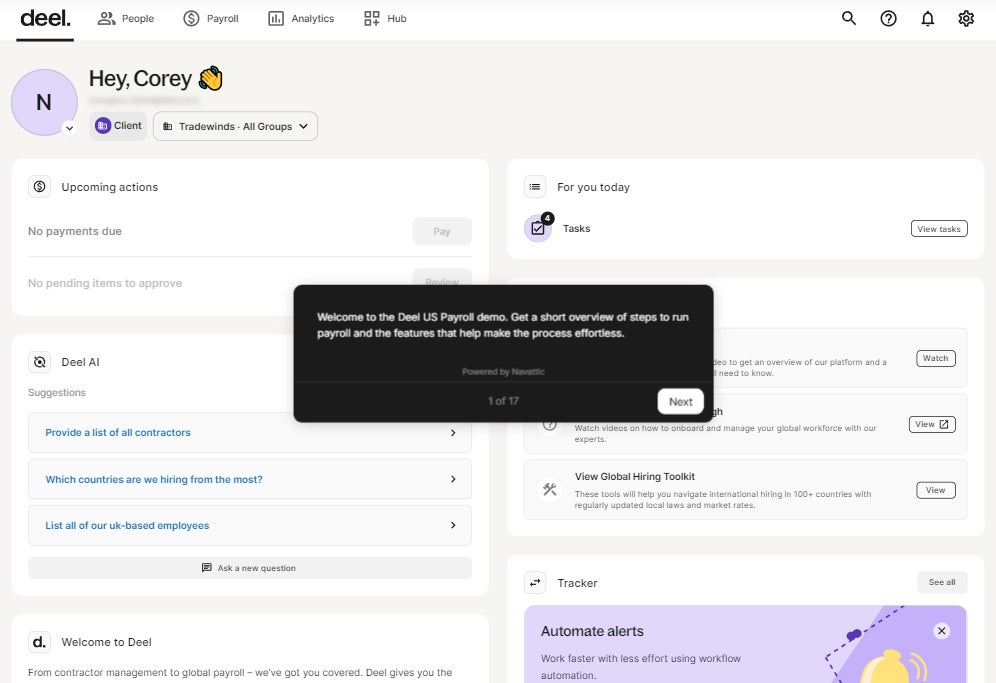

10. Deel: Best for affordability

Our rating: 3.47 out of 5

Deel offers a wide range of global and US payroll tools, including a US PEO option and an employer of record (EOR) service for hiring and paying global workers. For your one-employee business, Deel has a US payroll option with monthly fees that start at $19 per employee. This plan includes automated tax and wage calculations, tax filings at all levels (federal, state, and local), on-demand payroll compliance support, and registration assistance in 50 states. It also assigns a dedicated customer service manager who can answer your Deel-related questions.

It also offers various help articles, payroll guides, and a library of templates and HR resources with tips to make managing a global workforce easy for you. If you need a quick guide to using its key US payroll features, it has an online demo you can access.

Pricing

Monthly fees for Deel’s US payroll product start at $19 per employee. This is the cheapest plan on my list—provided you only use it to pay one employee. However, if you decide to grow into a multi-employee business, Deel’s US payroll package is pricier than the other pay processing software on my list. For example, if you have 10 workers, Deel will charge you $190 per month, whereas Roll by ADP and Gusto only cost $89 and $100 per month, respectively.

In addition to its US payroll product, Deel offers a US PEO service and global tools for hiring and paying international workers.

- Deel US PEO: Starts at $89 per employee per month.

- Deel Payroll: Starts at $29 per employee per month; includes global payroll-only tools.

- Deel Contractor: Starts at $49 per month; includes contractor payments in more than 150 countries.

- Deel EOR: Starts at $599 per month; includes international payroll and hiring tools.

Deel scored only 3.47 out of 5 in my evaluation because while it offers an affordable US payroll product, it lacks the automatic pay runs and fast payment options provided by some providers on my list. It also only offers chat and email support to its clients.

Deel pros and cons

| Pros | Cons |

|---|---|

| Has a wide range of US and global payroll tools | No mobile app for running payroll |

| Free HR information system (HRIS) for managing staff data | Gets pricey if you add more employees |

Why I chose Deel

While Deel tops our list of the best EOR services, its US payroll product is also a good option for paying only one employee. It offers the automated payroll calculations and tax filing services that Gusto, OnPay, and QuickBooks Payroll provide in their subscription plans, but at a lesser monthly fee. This lets you save on payroll software costs and use what you saved for product improvements or advertising programs to promote your business.

Like ADP and Justworks, Deel has a PEO option if you don’t want to handle payroll. If your business plans include expanding to countries outside the US, Deel’s EOR services can help manage your international payroll and hiring needs.

Learn more about Deel

- Read our full Deel review.

- Check these articles to see how Deel compares with other payroll providers:

Key features of one-employee payroll software

When choosing payroll software for a one-employee business, these are essential features to consider in your selection process.

- Scalability: You may be a one-employee business now, but you may need to scale your company in the near future. The payroll software you select should accommodate your growing pay processing requirements, such as multi-state pay runs if you expand your business to different states where some may have different labor laws and tax regulations.

- Automation: Running a one-employee business where you are responsible for different aspects of business growth and the risks involved can be taxing. Having a payroll solution where all you need to do is set up the software to handle payroll even when you are not looking is a feature your preferred payroll solution should have.

- User-friendly: The ability to use any business software tool without encountering many difficulties is critical to how successful you will be while using the tool. The same goes for payroll software. Consider a solution with an easy-to-navigate interface, straightforward installation, explicable reports, flexible integrations, and abundant resources on how to use the software.

- Security: Payroll involves the movement of funds, tax details, and other forms of personally identifiable information. With data breaches on the rise, cybercriminals are often attracted to such information and look for vulnerabilities to exploit. Therefore, it’s important to consider if the payroll software you want meets industry data security standards.

- Customization: As a one-employee business owner, you’re likely more interested in having things run as easily as possible. One way to achieve that is having an online system you can customize to your standard. For instance, your payroll report might contain extensive information you consider irrelevant and distracting. However, you can customize this report to fit your needs.

How do I choose the best one-employee payroll software for my business?

Choosing the best one-employee payroll software for your business requires careful consideration. Here are some tips on how you can make the right choice.

Consider the features

Payroll software features vary widely depending on the vendor and package you choose. Some offer basic features for calculating taxes, generating pay stubs, and making direct deposits. Others provide more advanced features like vacation and sick time tracking, employee benefits management, and tax filings. To help you choose a payroll service, create a payroll processing checklist and determine which features are essential for your one-employee business.

Check for compliance

Payroll taxes can be complex, and as a one-employee business owner, you may not be familiar with all the tax laws and regulations that apply to your business. You want to choose payroll software that automatically calculates and deducts payroll taxes and ensures all taxes are filed correctly and on time. Check if the software offers automatic tax calculation, tax form generation, and reminders for tax deadlines.

Consider integrations

If you are already using accounting or bookkeeping software, choosing a payroll solution that integrates with your existing solution is essential. Integrations help you avoid manual data entry and reduce the risk of errors.

Look for affordable pricing

Price is a significant factor when choosing payroll software. As a small business owner, you need to ensure that the software fits your budget. Look for payroll software that offers affordable pricing with no hidden fees or charges.

Check if the software you want offers a free trial and sign up for it. During that period, you can evaluate whether the features justify the cost.

Consider customer support

Even with user-friendly software, you may need assistance or have questions or concerns about the platform. Therefore, it is crucial to choose payroll software with excellent customer support. Check if it has multiple support channels like phone, email, chat, or a knowledge base. Then, choose a software vendor that provides responsive, knowledgeable, and helpful customer service.

Payroll for one-employee businesses FAQs

Should I use a payroll service for one employee?

Yes, you should. There are many reasons why your business needs a payroll service, even if you only have one employee. With a payroll service provider, you minimize the risk of pay-related errors while ensuring accurate and timely employee payments. It also helps you save time from running payroll, allowing you to focus more on day-to-day business operations and implement strategies that help grow your company.

Can I do payroll without a payroll service?

While managing payroll yourself is possible, I recommend it only if you have basic payroll needs and have fewer than 10 employees to pay. You should also be familiar with payroll tax regulations and labor laws and be willing to handle tax payments and form filings with appropriate government agencies.

How to run payroll if self-employed?

Running self-employed can be confusing and requires several steps. The first is securing the required federal and state tax IDs. Then, you need to select a payment frequency that meets state requirements. You should also identify your business entity or structure (e.g., sole proprietorship or S Corp) because this can impact taxes. Once you have those in place, the basic process of paying yourself includes calculating gross wages and withholding the applicable payroll taxes and deductions. You must also remit tax payments and file the appropriate tax forms to the IRS.

For a step-by-step guide, check out our how to do payroll guide.

Methodology

To determine the best payroll software for one-employee businesses, a collaborative assessment was made using a rubric with criteria that considered pricing, platform functionalities, payroll features and services, customer support, and user reviews from third-party review sites like G2, Capterra, and TrustRadius.

A total of 16 payroll software were evaluated where I used in-depth research, available free trials or demos to understand each platform’s functionalities, and my over five years of experience reviewing payroll systems to provide expert scores and narrow the list to the top 10 options. Below is a list of the software I reviewed.

- Roll by ADP

- Gusto

- QuickBooks Payroll

- Paychex Flex

- OnPay

- Square Payroll

- Paycor

- Patriot Payroll

- Wave Payroll

- Justworks

- Deel

- SurePayroll

- APS Payroll

- Bambee

- Buddy Punch

- RUN Powered by ADP

Here’s a breakdown of the rubric’s scoring criteria:

- Pricing: Weighted 20% of the total score.

- Platform/interface features: Weighted 20% of the total score.

- Payroll services: Weighted 15% of the total score.

- Payroll features: Weighted 25% of the total score.

- Customer support: Weighted 15% of the total score.

- User reviews: Weighted 5% of the total score.

Other experts who contributed to this article’s rubric assessment include:

- Irene Casucian who conducted the initial software research and objectively scored the rubric based on specific criteria.

- Jessica Dennis who created the rubric’s criteria and selected the products for Robie and Irene to review based on her hands-on experience with HR software, her payroll expertise, and her over six years of experience as an HR generalist.