- XRP dropped to $2.14 amid declining market confidence. Derivatives information confirmed a 2.66% dip in Open Curiosity and vital liquidation of lengthy positions.

- Technically, XRP is buying and selling close to vital assist ranges, with instant zones at $2.11 and $2.14.

Wednesday was a bullish day for Ripple’s XRP, which hit intraday highs of $2.30 within the midweek. The rally is a part of elevated positivity within the crypto house, feeding off the higher geopolitical resonance. U.S. President Donald Trump’s softened rhetoric towards Federal Reserve Chair Jerome Powell and extra constructive tone towards discussions with China lifted investor sentiment. In consequence, digital asset costs throughout the board rallied on the hopes of easing pressure, and progress was perceived.

XRP Value Sees Rollercoaster Trip

Nonetheless, by Thursday, the stress was again on XRP, shedding to only beneath $2.14 in the course of the European buying and selling session. Nonetheless, the pullback itself is a sign indicating a change in sentiment throughout the whole crypto market with respect to short-term bullish momentum.

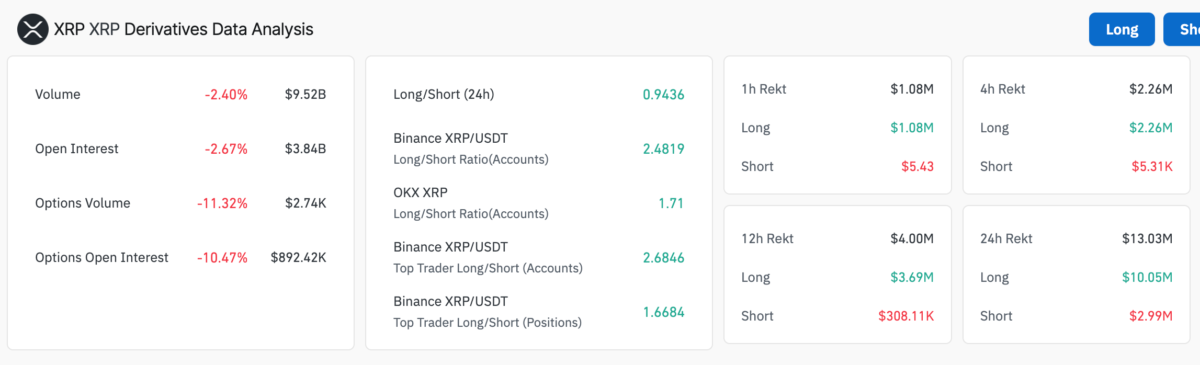

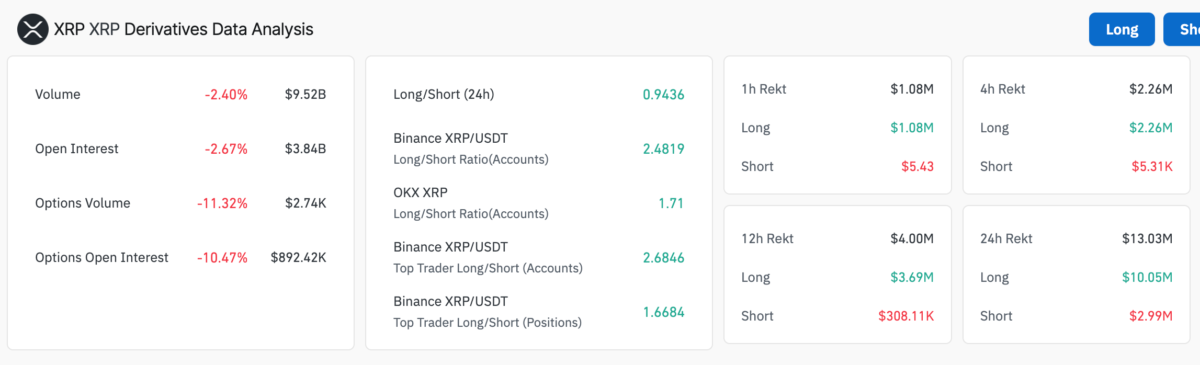

CoinGlass data reveals that XRP’s derivatives metrics have made a pointy decline. The Open Curiosity (OI), a gauge of lively futures contracts, is down 2.66 per cent previously 24 hours to $3.84 billion. A drop, nonetheless, is a mirrored image of the much less appetites of speculators, that’s, much less dealer confidence and a attainable decline in buying and selling exercise.

Together with the OI dip was an enormous wave of liquidation. The lengthy positions took a beating, and $10.05 million price of leveraged purchase trades had been closed forcefully. Brief liquidations, nonetheless, had been seen by far decrease numbers, round $3 million. Such an imbalance displays the pace of a correction and an inflated variety of promoting exercise, with bullish bets taken abruptly by market reversal.

Additional alerts point out that the market is cooling. Rising 24-hour lengthy/quick ratio reached 0.9436 for XRP, indicating a better rising bias in bearish positions. The quantity of general buying and selling dropped 2.4% to $9.52 billion, including much more proof up to now that fewer individuals are engaged.

XRP Value Prediction: Key Ranges To Watch

On the technical facet, XRP value presently trades above the important thing shifting common assist ranges. Not too long ago, it has been examined at $2.11 on the 8-hour chart on the 50-period Exponential Shifting Common, and it’s near the easy 100 Exponential Shifting Common at $2.14. These indicators are instant zones of assist; failing right here might put the value in danger for additional decline.

In the meantime, market watchers at the moment are observing the Relative Energy Index (RSI) as it’s presently at 52.42. Slower from a bearish momentum, the RSI seems positioned close to the center, and thus the market might swing both course within the quick time period. As of but, $2.00 serves because the vital assist beneath the present ranges, which has served as a key assist since March. If XRP value breaches this stage because of deeper pullbacks, it might hover across the April low close to $1.62.